By Tileni Mongudhi and Shinovene Immanuel| 19 October 2021

FIRST National Bank Namibia wants to shut down the bank accounts of several politically connected individuals linked to the Fishrot corruption scandal.

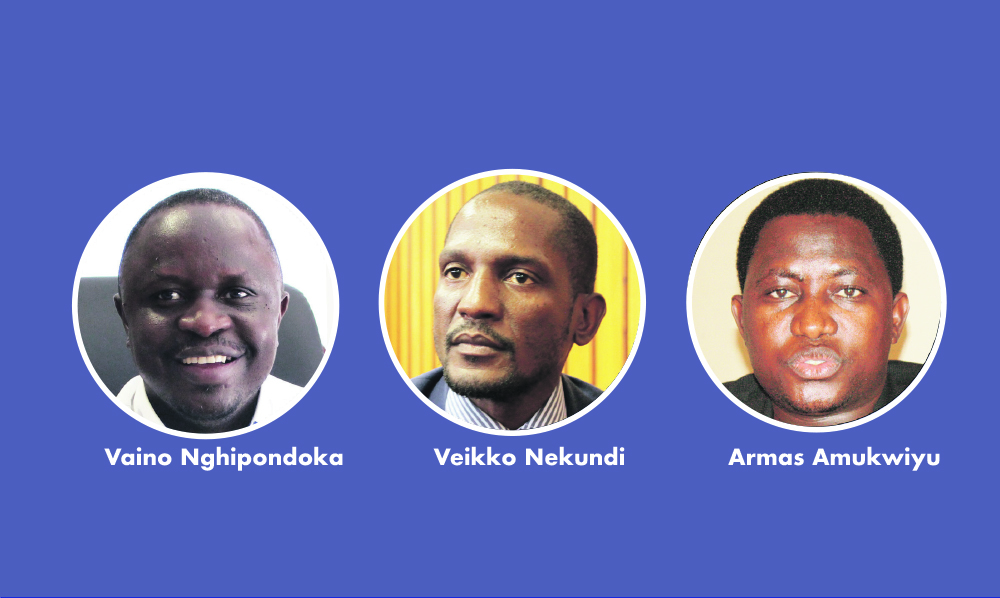

This includes deputy minister of works and transport Veikko Nekundi, Swapo regional coordinator Armas Amukwiyu, and businessman Vaino Nghipondoka.

The bank has also dispatched termination notices to its clients who are currently in jail awaiting trial in connection with the scandal.

Some of the Fishrot-accused FNB clients include former Investec Asset Management Namibia managing director James Hatuikulipi, his cousin Tamson ‘Fitty’ Hatuikulipi, former minister of justice Sacky Shanghala, and Ricardo Gustavo.

This comes around two years after FNB dumped oil speculator and wheeler-dealer Knowledge Katti for business dealings not related to the Fishrot case.

The Namibian has established that FNB decided to make these moves in a derisking exercise aimed at fighting money laundering and corruption.

FNB spokesperson Elzita Beukes yesterday said the bank cannot publicly discuss any decisions taken on private accounts or on any ongoing legal investigations.

She said the bank reserves the right to terminate any contractual banking relationship if it poses an unacceptable risk.

FNB is one of the banks named in court documents as having been used to transfer tainted Fishrot funds which were used by the Fishrot accused to buy assets.

Some of the accused have also bought corruption-tainted residential properties through FNB Namibia.

Namibian Sun earlier this year reported that at least 23 vehicles worth N$24 million are the subject of a court battle between FNB and prosecutor general Martha Imalwa.

The bank is still owed money on many of the vehicles purchased through loans extended by it.

It appears the bank is now trying to clean up its position while it fights Imalwa, who is hell-bent on confisticating assets of the Fishrot accused.

The Namibian has seen a letter dated 3 June, notifying one of the affected clients that their relationship with the bank would be terminated in 60 days.

“This review was done in light of adverse media publications by the Namibian media regarding yourself and your associated business on the underlying transactional behaviour on the various accounts held by FNB Namibia with individuals and entities linked to the ongoing Fishrot case,” the letter read.

The letter said the publicity and risk associated with the above does not resonate with the bank’s values and principles.

“In light of the aforesaid, FNB Namibia had decided to divest from its business relationship with you,” it stated.

The bank informed the involved clients that they have 60 days to make alternative banking arrangements.

These instructions are said to have come from the FirstRand Group, FNB’s mother company.

POLITICIANS

The Namibian last year reported that Nekundi was a beneficiary of N$20 000 paid into his FNB account from laundered Fishrot money.

The payment came from DHC Incorporated, which belongs to fugitive from justice Marén de Klerk.

The transfer was made to Nekundi’s FNB account on 11 September 2017.

Nekundi could not explain why and how the money ended up in his account.

FNB is, however, closing this account.

Nekundi did not respond to questions sent to him.

Amukwiyu is another politician set to lose his FNB Namibia account.

His entity benefited from at least N$5,2 million, which was allegedly stolen from national fishing company Fishcor.

The N$5,2 million was transferred from Sisa Namandje Inc & Co to the Gwashihwemwa Family Trust, which was controlled by Amukwiyu in December 2015.

Amukwiyu allegedly also used dirty money to buy a Land Rover Discovery, which he has since handed over to the authorities.

Amuwkiyu, who is currently studying in China, did not respond to questions sent to him.

Businessman Nghipondoka also benefited from N$15 million allegedly stolen from Fishcor in December 2015.

Documents show that around N$9,8 million of that amount was transferred through Sisa Namandje Inc & Co to Nghipondoka via his companies.

Around N$2,5 million was used to buy Nghipondoka’s farm Apostle at Otjiwarongo.

Nghipondoka has in the past denied any wrongdoing.

He claimed the N$9,8 million was repayment on “a loan” by the now-disgraced business executive James Hatuikulipi, who was the chairperson of the Fishcor board at the time.

Nghipondoka on Sunday confirmed that he has “problems” with FNB Namibia, but said it is a confidential matter.

The businessman denied speculation that he has left Namibia to settle in Dubai.

“I go there to work,” he said, adding that he is in the process of expanding his business globally.

“Tell them it’s none of their business what I do in Dubai,” he said.

Ronald Kurtz, representing James Hatuikulipi, Shanghala and Pius Mwatelulo, says: “I haven’t got any instructions in that regard. I am also not aware of anything of that sort.”

Richard Metcalfe, who represents Esau and Tamson Hatuikulipi, says he is not aware of the bank’s notices to his clients.

Gustavo’s lawyer, Trevor Brockerhoff, says: “We read of these assertions in Namibian Sun a few weeks ago, however, we have yet to receive any formal communication as to this stance from the bank.”

‘DEAR LIFE’

Another businessman targeted by FNB Namibia is exploration speculator Knowledge Katti. He is not linked to the Fishrot corruption saga.

Sources say his FNB Namibia bank account was closed two years ago due to his close ties with his Uruguayan business partner Gaston Savoi.

Savoi is the founder of Intaka Technology and is currently fending off corruption and bribery charges in South African courts emanating from a 2010 arrest, implicating Intaka Technology in corruption.

Intaka’s relationship with Namibia’s Ministry of Health and Social Services of over a decade has also been marred by allegations of the substandard delivery of life-saving oxygen, and questionable contract renewals.

Katti did not respond to questions sent to him yesterday.

FNB’s latest developments come as a result of international pressure compelling financial institutions to do their part in the fight against corruption and money laundering.

The decision coincides with the Bank of Namibia’s September 2020 Determination under the Banking Institutions Act, which now bars banks from appointing politically exposed non-executive independent board members.

The new rules, which will take effect next year, also limit the terms of non-executive independent board members to 10 years.

Also seen as contributing to this decision was the fact that Namibia was this month undergoing a review and inspection by the Financial Action Task Force and the Eastern and Southern African Anti-Money Laundering Group.

The review was to determine the country’s preparedness and ability to effectively combat money laundering and corruption.

If Namibia does not pass the review, the country could be black-listed as a destination for corruption and money laundering.

The Bank of Namibia and the Financial Intelligence Centre, the Namibia Financial Institutions Supervisory Authority, the police, the Anti-Corruption Commission, the Office of the Prosecutor General, and the Ministry of Justice have all been thoroughly scrutinised.

A source familiar with the assessment says Namibian officials have been grilled for what appears to be the country’s failure to take a hard stance against money laundering.