By Shinovene Immanuel | 20 June 2018

This was among the findings contained in a 21 June 2018 draft report compiled by KPMG Namibia, which was submitted to the government recently.

The report is part of the tax evasion investigation which targeted a string of companies owned primarily by Chinese business people operating in Namibia.

The initial amount that was being investigated was N$3,5 billion, in a case which led to the arrest of several people, including President Hage Geingobs friend and former business partner, Jack Huang, who is now out on bail.

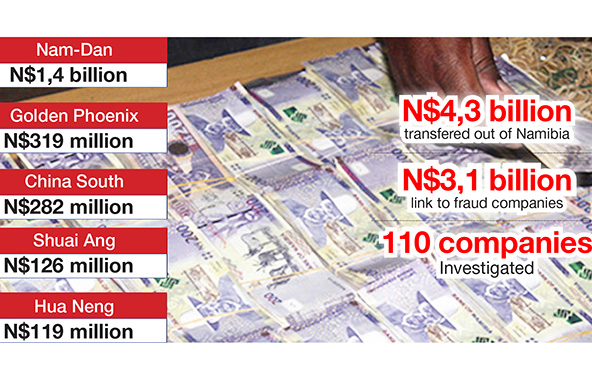

The KPMG report indicates how the implicated companies transferred N$4,3 billion out of the country between 2013 and 2016, of which N$3,1 billion was transferred through 11 Chinese companies.

The money, the report said, was channelled out of the country through a Namibian company called Extreme Customs Clearing Services (XCCS), which is a key link in the tax evasion and fraud case. Clearing agents are responsible for the preparation and submission of documentation required for exports or imports into the country.

This is the same company which imported President Geingobs tax-free furniture, valued at N$1,6 million, in 2015.

However, it is unclear whether this transaction was also investigated.

The KPMG report said the N$3,1 billion was transferred by companies such as Nam-Dan (N$1,4 billion), Golden Phoenix (N$319 million), China South (N$282 million), Shuai Ang Investments (N$126 million), Hua Neng (N$119 million), Jia Mu Trading CC (N$60 million) and Shashi (N$25 million).

Golden Phoenix was owned by politically connected Huang, who has denied any wrongdoing, and has claimed that he resigned from the company 11 years ago.

The report found that a transfer of N$60 million out of the country by Jia Mu Trading CC was fraudulent.

“On the grounds of the misinterpreted documents and potential tax evasion, the remittance (transfer) of funds out of the country by XCCS and/or Organised Freight Services, on behalf of Jia Mu, amounts to potential money laundering,” the report added.

Namibian authorities found that invoices used by Chinese-owned businesses, mostly based at Oshikango on the border with Angola, for the payment of customs duties on goods imported into Namibia, and those for payments to the suppliers of the imported goods based in China, did not match.

This, investigators said, was done to ensure that less tax was paid on the imported goods, but the same invoices were later inflated to pay out large sums of money through Namibian banks to Chinese accounts.

The report says investigators looked at more than 1 750 invoices and 110 companies, but the majority of the N$3,1 billion fraud was linked to 11 companies that dealt with XCCS, whose owner, Laurensius Julius, was accused of under-declaring the value of goods imported into Namibia.

The report, seen by The Namibian, shows that KPMG Namibia concluded that there was evidence that supports the suspicion of “trade-based money laundering” by some of the companies investigated.

The report says the N$3,1 billion transactions involved money laundering, tax evasion, under-declarations and racketeering.

“The evidence from shipping companies has demonstrated that freight charges on invoices presented to the bank were significantly misrepresented to facilitate [payment] greater than the amount obligated,” the report states.

The investigation also found that N$407 million in cash deposits were made into Extreme Customs Clearing Services bank accounts between November 2014 and February 2015.

Some of those deposits were made by an entity known as Nam-Dan, which made 15 deposits totalling N$60 million.

The report also said an entity known as Shuai Ang Investment CC made three deposits totalling N$3,8 million.

Golden Phoenix made 13 deposits amounting to N$13 million into Extreme Customs Clearing Services bank accounts.

A person familiar with the matter said authorities were still questioning large sums of money paid into the bank account of Extreme Customs Clearing Services, including a N$400 million transaction.

Police Inspector General Sebastian Ndeitunga told The Namibian yesterday that he has not yet seen the KPMG report, but promised that no one would be shielded.

This pledge comes as there have been murmurs that some Chinese business people were being protected because of their links to national leaders.

STIFF DENIALS

Extreme Customs Clearing Services owner Julius, who is painted by Namibian authorities as the kingpin in the multibillion dollar tax fraud case, has so far denied any wrongdoing.

Julius said in court last year that he had been alerting the finance ministry about discrepancies that his company discovered in respect of invoices for goods that its customers imported into Namibia.

The company was preparing for its annual audit when it found that the value of imports reflected on invoices submitted to the Ministry of Finance for the calculation and payment of customs duties differed from the values on invoices used to make payments to the suppliers of the goods.

Having detected the discrepancies, the company contacted customers to inform them of the matter, Julius said.

The response which they got from their customers was that it was how they received invoices from China, and that it was the way they operated, he said.

XCCS sent a letter to the Ministry of Finance on 1 April 2016 to inform it of the discrepancies in respect of the invoices, and to ask for a review of the customs duties that had to be paid on the imports involved, Julius also told the court.

As a result of the review, penalties amounting to about N$1,3 million had already been paid or were to be paid to the ministry, while additional customs duties of about N$3,8 million have also been paid, and a further N$3,4 million was still to be paid, Julius said.

He never intentionally defrauded the Ministry of Finance, and did not at any stage make misrepresentations to the ministry either, he added.