By Lazarus Amukeshe | 26 April 2019

However, Namdeb Holdings, the joint venture between the government and De Beers, alone pumped more than N$10 billion into state coffers from its N$61 billion income over the same period.

Namdeb, therefore, paid about 95% of the N$11 billion corporate tax paid by all mining companies which had a combined revenue of N$146 billion over the five-year period.

The Namibian got these details during a three-month investigation of the contribution made by various mines to the government’s tax base, using data from the Chamber of Mines of Namibia, national budget documents, mining companies’ annual reports, as well as interviews with experts in the extractive field.

The figures paint a picture of a government that heavily relies on one company to fund a highly indebted treasury, while other mining entities rake in billions, but pay little or no corporate tax at all – something that the tax office claims it’s aware of.

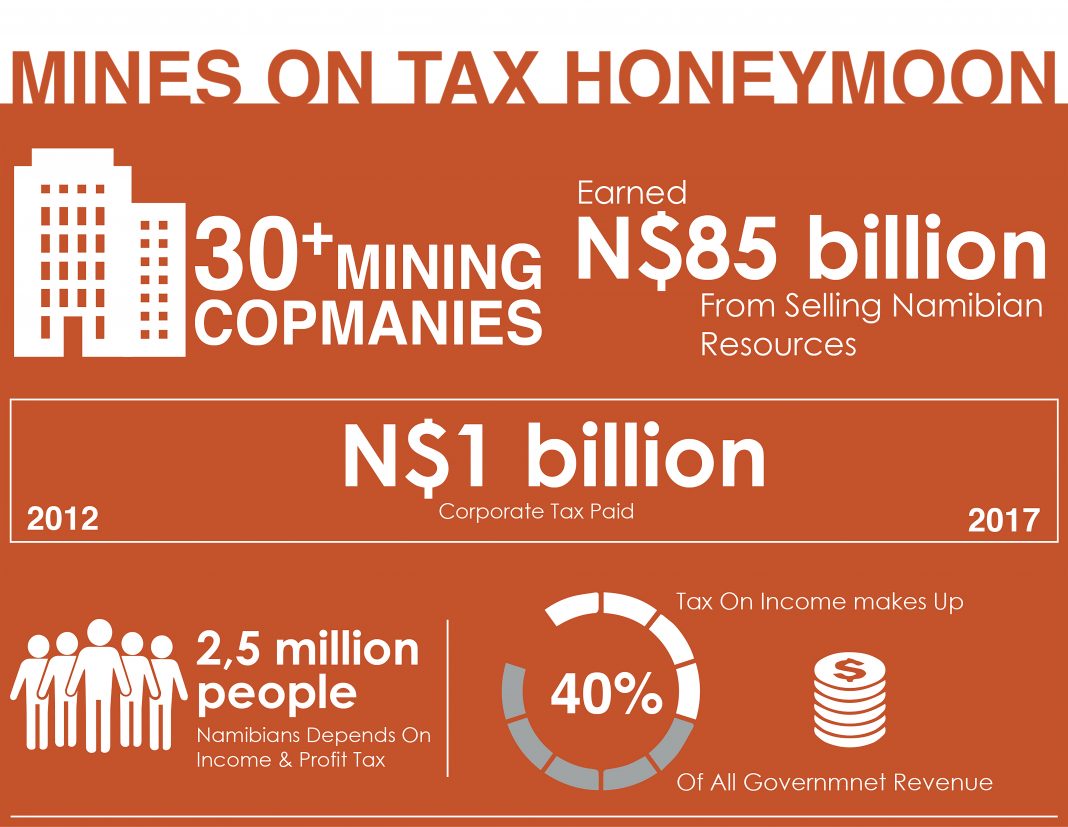

The Namibian government relies on income and profit taxes for revenue. This year’s national budget documents show that these taxes make up about 40% (N$21 billion) of the government’s total income.

As of 2019, Namibia had 34 eligible taxpaying mining entities.

Mining is Namibia’s primary economic sector, and accounts for more than 50% of all exports every year.

The country is home to mining companies such as De Beers, Glencore, Rio Tinto, B2Gold, Paladin Energy, Vedanta Resources, Areva Resources, Dundee Precious Metals, China General Nuclear Power and Weatherly International.

Among the critical minerals are uranium, zinc, gold and diamonds.

Namibians own less than 10% in most mining entities, with the state-owned mining company Epangelo Mining holding minimal shares in mines around the country, including a 10% stake in Swakop Uranium’s Husab mine.

While some companies claim they are not profitable to pay corporate tax, others such as Dundee Precious Metals at Tsumeb do not pay tax because it was accorded export processing zone status which exempts it from paying corporate, indirect taxes and other levies.

Dundee’s income between 2013 and 2017 was around N$6,8 billion.

Chinese state-owned Swakop Uranium, which runs the Husab mine, declined to provide The Namibian with information on taxes. There is no indication what sort of taxes they paid, if any.

SNOOZING TAXMAN

The global pressure group, Tax Justice Network, said bankers, lawyers and major accounting firms help companies avoid paying taxes which could be used for development projects in developing nations.

These major accounting firms also advise the government on how to deal with tax dodgers.

The Namibian reported last year that Paladin Energy, owners of Langer Heinrich mine, bought an old company in Mauritius, and used it to avoid a N$219 million tax bill in Namibia in 2014. The company denied any wrongdoing, but the finance ministry announced last year after the story was published that it was investigating the matter.

Nadine du Preez, director of Namibia’s large taxpayers’ office and investigations at the finance ministry, said they are aware of only one company paying a more significant chunk, and said mines pay other taxes such as VAT and withholding taxes.

However, with many of the mining companies with subsidiaries in countries which Namibia has tax treaties with, experts suspect that these companies did not pay withholding taxes because most of the treaties Namibia has, give taxing rights to other countries where capital and services come from.

Du Preez stated that some mining companies used schemes that reduce their taxable income.

Her office has started transfer pricing audits to determine if arm’s length principles were applied between inter-company dealings, and to curb tax avoidance generally.

However, she declined to explain the action taken on tax abusers.

There are no rules on how long back the taxman can demand answers on tax avoiders, even if companies go free and exploit tax loopholes.

Earlier this year, tax authorities in Australia tried to recover tax avoided by mining company BHP Billiton in the 1960s.

DEFENDER

Mining companies in Namibia pay corporate tax at a much higher rate than non-mining entities.

Diamond companies are subject to an effective 55% corporate tax rate, while non-diamond mining companies pay 37,5%.

Key mining spending such as exploration expenses and royalties are tax-deductible, and assets are written off over three years.

Information from the Chamber of Mines shows that exploration expenditure from 2012 to 2017 stood at about N$3 billion, which tax officials claim contributed to tax losses.

Chamber of Mines’ chief executive officer Veston Malango told The Namibian this year that mining requires huge capital investments, forcing companies to make losses.

“Namdeb is taxed at a higher rate, even royalties are at 10%, which could be why they are the highest contributor. We are, however, not saying that mines are carrying tax losses solely because of huge capital investments, but it has an effect,” Malango said.

Statistics from the chamber show that for the past six years, capital investments stood at about N$38 billion, which are mostly private sector-sourced through debt and equity instruments, with the Chinese government backing mining operations in which they have interests.

Exports to China have increased drastically over recent years, with 2018 recording a N$5,5 billion uranium export, albeit mines running on tax losses.

Malango dismissed speculation that mines in Namibia export raw minerals, saying it only happens when mines start operating, but as years go by, they had started adding value.

HOTBED

Namibia was listed as a non-cooperative tax jurisdiction by the European Union in 2017 for creating an environment for companies to engage in tax evasion and illicit financial flows.

It was removed from the list last year after committing to improving its tax laws.

Finance minister Calle Schlettwein had proposed new tax rules last year to this effect. Analysts have argued that the rules would collapse the already struggling economy, which the minister had dismissed, saying analysts seem to be advocating the erosion of the tax base.

These rules were revised in 2019, which now include the non-deduction of royalties from non-diamond mining operations. For 2018, these royalties were around N$380 million.

Extractive industry expert Jaqueline Taquiri said mining companies pay little to no taxes when they use schemes such as overpricing sales, excessive interest deductions, and the undervaluation of mineral exports.

She said across all sectors, Africa loses about N$2,6 trillion through tax avoidance every year.

Taquiri added that although it is true that mining requires massive investments, mining companies also engage in tax-reducing schemes.

Former prime minister Nahas Angula, who has been critical on how the government was too heavily dependent on natural resources, told The Namibian this year that the situation of one mine paying the majority of mining tax was “dreadful”.

“It is a known fact Africa-wide that resources are abused and exploited by multinational companies,” he told The Namibian in February.

Angula stressed that there is a lack of skills in government.

“We also do not have the follow-up capacity and expertise to ensure that the information that mining companies give is accurate. Tax avoidance by transfer pricing and other means is happening, not only in the mining sector, but in other sectors as well,” he stated.

Transfer pricing refers to the prices of goods and services exchanged between two or more related companies. These prices can be manipulated to reduce income and consequently tax to the government.

Namibia’s new tax agency is expected to start operating in October this year.

*This article was produced by The Namibian’s investigative unit with support from Finance Uncovered. investigations@namibian.com.na