By Mathias Haufiku and Tileni Mongudhi | 10 April 2020

THE Law Society of Namibia is seeking a search and seizure warrant to allow it to inspect the records of the law firm Sisa Namandje & Co Inc in connection with N$23 million allegedly linked to the Fishrot scandal.

It has asked the High Court to compel Namandje & Co to open up its books.

However, the judge decided not to grant the Law Society’s request before Namandje was heard.

The court action comes after Namandje contested several attempts to inspect the firm’s books, contending that the society flouted some of its own procedures.

Court documents filed by the Law Society last week lay bare new details about transactions channeled through the firm’s trust account.

They include the payment of N$2,1 million for a farm bought by businessman Vaino Nghipondoka using funds from the National Fishing Corporation of Namibia (Fishcor).

In addition, the documents raise questions about internal transfers and dealings at Namandje & Co.

Namandje has filed court papers to oppose the case. He has in the past maintained he is not opposed to an investigation.

The Law Society started looking into Namandje & Co’s alleged role in the Fishrot scandal in December last year, but says the probe has been hindered by non-cooperation.

“The Council has decided to lodge an investigation into legal practitioners involved in the Fishrot scandal and has expressly included resort to such an application in the event of resistance on the part of a legal practitioner in question,” director of the Law Society, Retha Steinmann, said in court papers filed last week.

At the heart of the Law Society’s investigation is whether Namandje & Co’s trust account was used for money laundering activities.

“[I] have reason to believe that Mr Namandje and/or the other directors at Sisa Namandje & Co Inc may have engaged in money laundering activities using the firm’s trust account, and in the course thereof have contravened the requirements for the keeping of trust accounts in a number of respects,” Steinmann said.

THE MONEY TRAIL

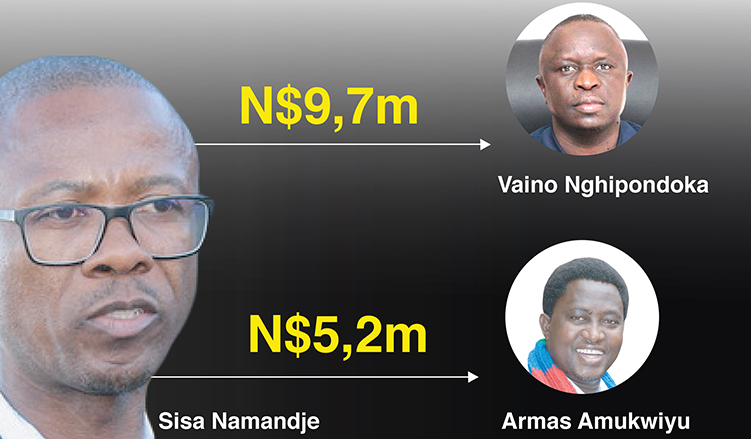

Transactions in excess of N$23 million were allegedly channeled to politically connected people.

It is made up of three payments: N$15 million from Fishcor to Nghipondoka and Swapo Oshikoto regional coordinator Armas Amukwiyu in 2015; another N$2,5 million from Fishcor; and N$5 million deposited by Samherji-owned Mermaria Seafoods Namibia. Both the N$2,5 million and N$5 million are yet to be explained. Fishcor has in the past refused to comment on these transactions.

The court papers break down how the N$15 million was disbursed.

They show that Namandje paid around N$9,7 million to Nghipondoka of which N$2,1 million was used to pay for a farm for Nghipondoka (Farm Apostle) near Otjiwarongo. It was bought through Van der Westhuizen & Greeff Associates. Efforts to get comment from Van der Westhuizen & Greeff were not successful.

Namandje paid the remaining N$5,3 million of the N$15 million into an account belonging to the Gwashihwemwa Family Trust of which Amukwiyu is a trustee and beneficiary.

The Law Society said Namandje’s firm should have “red-flagged” these transactions – especially as Nghipondoka and Amukwiyu were politically exposed persons.

“Due to their positions and influence, it is recognised that many politically exposed persons are in positions that potentially can be abused for the purpose of committing money laundering offences and related predicate offences, including corruption and bribery,” Steinmann said in the court papers.

Nghipondoka and Amukwiyu have in the past denied any wrongdoing. Nghipondoka said the money paid to him was a repayment for a loan he made to Fishrot accused James Hatuikulipi, and he did not know it came from Fishcor.

TWO MORE PAYMENTS

The Law Society also questioned the other two payments which formed part of the N$23 million paid into the Namandje trust account.

The first payment includes the N$5 million made by Mermaria Seafood Namibia on 28 August 2017. Mermaria Seafoods Namibia is owned by controversial Icelandic firm Samherji.

The court papers mention that preliminary investigations indicated the payment records did not match up.

It was referenced as “Fishcor” in Mermaria’s bank records, but is shown on the trust account’s bank reconciliation records as “direct deposit-Lemon”.

The Law Society suspects “Lemon” refers to Lemon Square, a fishing company solely owned by Namandje.

The second payment was N$1,4 million which was deposited from Namandje’s trust account on 7 September 2017 to lawyer Sacky Kadhila-Amoomo.

“This payment was made into Mr Kadhila’s personal bank account held at First National Bank,” Steinmann said.

“This would mean that the Mermaria Seafood payment into Sisa Namandje & Co Inc’s trust account was a direct payment from the Icelandic interests and it would also mean that Sisa Namandje & Co Inc, Mr Namandje himself and Mr Kadhila benefited directly and personally from Icelandic interests.”

Steinmann said it was “impermissible for the legal practitioner to receive funds in trust which are not linked to the provision of legal services by the legal practitioner connected to the matter”.

She said a response to calls for an explanation on questions over the Fishcor payments had not been forthcoming.

In the court papers, the Law Society argues it could only be determined whether Namandje or any of his co-directors engaged in suspected money laundering using the firm’s trust account if access was granted to the firm’s records.

INTERNAL TRANSFERS

The Law Society also takes issue with a transfer made to Nedbank for a loan Namandje & Co took to construct its office building.

It said direct payments of the firm’s expenses from the trust account were prohibited.

One such transaction is N$1,1 million paid from Namandje’s trust account towards the repayment of his firm’s mortgage.

Records seen by The Namibian indicate money was transferred from the account to a close corporation Namandje personally owns, Simonya Namandje Square CC.

“A firm’s business expenses may not be paid directly from the trust account. All funds in the trust belongs to the client until such a time that the legal practitioner is lawfully entitled to those funds, at which point they must be transferred to the business account,” Steinmann said in the court papers.

“I wish to stress that the purpose of the Law Society’s inspection is to determine whether the firm has indeed contravened the requirements relating to trust accounts and whether it has engaged in money laundering or facilitated money laundering by its clients,” she said.

“Depending on the findings of the inspection, the firm would be either cleared, or in the event that violations and transgressions are found, would be given an opportunity to respond to the findings. Depending on the firm’s response, the Law Society would either refer the matter to the disciplinary committee or conclude the matter there.”

NAMANDJE RESPONDS

“The allegations you want us to comment on are a subject of investigation of ACC with whom we are cooperating. We are further currently preparing a comprehensive statement under oath to it [ACC] as agreed with it setting out our legitimate involvement in clients’ transactions concerned and adequately demonstrating that we were not involved in any criminal activities.

“In view of such ongoing investigation and the continuing interaction between us and ACC it will be improper for us to make public comments on the matter.

“In respect of the pending court case between us and the LSN to be heard on 7 May 2020, we have since filed a notice to oppose the LSN’s application and our counsel is now busy

finalising opposing affidavits which affidavits will demonstrate that the LSN’s application must fail on the basis of several legal and factual grounds. In fact, the LSN’s application,

almost entirely, is based on wrong assumptions, unjustified interferences and various factual inaccuracies. However, in view of the fact that the matter is now sub judice, we cannot publicly discuss the matter.

“We therefore reject any insinuation of wrongdoing and remain prepared and determined at all times to protect our rights and that of our clients including their privileged instructions and information to which the public is not entitled to.

“Finally, we want to ask you to exercise extreme caution in respect of the allegations you intend reporting on in view of the fact that the LSN relies on FIC [a Financial Intelligence Centre] report which is full of factual inaccuracies and which we were never given an opportunity to comment on and which, as admitted by the LSN, it does not have consent to use in court proceedings. That report will have to be struck from the court papers. In this respect we reserve our rights should you proceed and make defamatory allegations despite us alerting you of the defects and factual inaccuracies in the LSN’s application.”

*This article has been amended in the second sentence under Namandje’s response: “…transactions concerned and adequately demonstrating that we were not involved in any criminal activities”. The initial quotation left the impression that Namandje’s client engaged in criminal activities. We apologise for the error.