By Timo Shihepo and Eliaser Ndeyanalei | 25 September 2024

Part of the N$79 million stolen from SME Bank was used to buy luxury vehicles such as an Aston Martin, a McLaren and a Mercedes-Benz for individuals in South Africa.

This is according to bank records and court documents filed in South Africa’s Gauteng High Court by the SME Bank’s liquidators, Ian McLaren and David Bruni.

Former SME Bank chief executive Tawanda Mumvuma and ex-finance manager Joseph Banda are named in court documents as masterminds, alongside the co-owner of the bank, Enock Kamushinda.

They are accused of making dubious payments to a South African company called Asset Movement Financial Services (AMFS) between 2015 and 2016.

“At all times, the authoriser (in SME Bank) paid money to AMFS. In total, an amount of N$79 800 000 was paid to AMFS under the mistaken belief that the money was due, owing and payable to them, while in fact [it was] not the case,” noted the liquidators.

The liquidators claimed that AMFS received the money, which was further distributed to car dealerships for the benefit of designated individuals, effectively concealing the fraudulent nature of the transactions.

The funds were subsequently allegedly used to buy vehicles for individuals such as Alekos Alexandrou from Johannesburg who got luxury vehicles worth N$5,4 million.

Alexandrou is listed as the biggest beneficiary of the scheme.

The other beneficiaries are Robert Lane (from Gqeberha), Keong Lee (Johannesburg) and Patience Varaidzo Wushe and Sitabile Mathipano (from Zimbabwe, but living in South Africa).

AMFS was “nothing but a vehicle used … to steal and distribute the SME money,” said the liquidators.

These individuals and companies, now named as defendants, have denied any wrongdoing, claiming to have paid in full for the vehicles.

The liquidators said the defendants are the beneficiaries of the fraud perpetrated on the SME Bank, an institution that was set up to serve small businesses and rural communities in Namibia.

Mumvuma did not respond to questions sent to him this week.

ONE CAR HERE, ONE CAR THERE

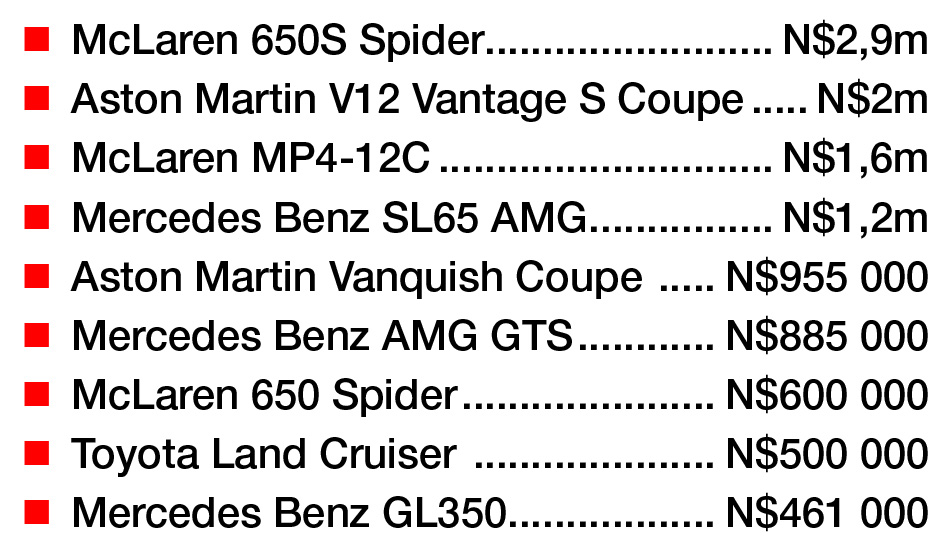

Court documents show that SME Bank funds were allegedly used to purchase cars for the following individuals:

An Aston Martin Vanquish Coupe for Lane on 6 July 2015 for N$955 000

A N$2,9 million payment was made to Daytona Pty Ltd on 15 July 2015 to buy a McLaren 650S Spider for Lee.

Alexandrou allegedly got four cars worth N$5,4 million. The vehicles are a McLaren MP4-12C, McLaren 650 Spider, a Mercedes -Benz SL65 AMG and an Aston Martin V12 Vantage S Coupe.

A Mercedes-Benz AMG GTS worth N$885 000 was bought for Florio Poone Diamonds on 5 November 2015.

Two payments, N$184 000 and N$277 000 made on 7 and 9 March 2016 were received by East Rand Toyota for the purchase of a Mercedes-Benz GL350 TEC for Wushe.

N$500 000 was paid on 9 February 2016 to Halfway Toyota Fourways to buy a Toyota Land Cruiser 200 VX4 for Mathipano.

The liquidators said the car recipients have denied being beneficiaries of the money stolen from SME Bank.

“They allege that they themselves paid in full for the vehicles. They allege that they have no knowledge of the transactions.”

THE SYNDICATE

This syndicate was allegedly executed through key SME Bank officials.

Banda, allegedly abused his authority as chief financial manager by fraudulently approving all payments to AMFS.

The liquidators said Mumvuma provided overarching approval for the illicit transactions.

According to McLaren and Bruni, employees in the finance department were complicit in preparing fraudulent payment instructions that were ultimately processed.

The liquidators alleged that the authoriser at the bank was misled into believing the payments were legitimate and necessary, leading to the transfer of funds.

“The defendants (AMFS and the car recipients) were enriched in the respective amounts mentioned. The SME Bank was impoverished. The defendants’ unjustified enrichment is at the expense of the SME Bank,” said the liquidators.

The Namibian has in the past reported that the SME Bank loot was allegedly used to pay N$740 000 for former Namib Desert Diamonds chairperson Tania Hangula’s E250 Mercedes-Benz.

Minister of agriculture, water and land reform Calle Schlettwein’s executive assistant Esau Mbako bought a Toyota Land Cruiser V8 VX for N$700 000.

THE VICTIMS

The SME Bank saga has left scars on some of the poorest Namibians.

In 2017, The Namibian reported that tens of desperate Katutura residents stormed the SME Bank building in the hope of recovering their money after it was shut down by the central bank.

The majority were domestic workers, gardeners, vendors, self-employed people and office cleaners, clerks and packers.

Many of them had saved money over a period of time.

To them, the closure of the bank has been hell on earth.

Last month, the liquidators said 23 000 depositors from the bank will share N$30 million at a rate of 15 cents for every dollar deposited with the ill-fated bank.

DENIALS

Mathipano’s legal representative, Andrew Duff, said they reached out to their client pertaining to The Namibian’s questions, but have not received a response.

“Accordingly, we record that the matter is sub judice (currently being litigated) and accordingly have no comment related to any allegations or questions raised,” Duff said.

Duff added: “Kindly note that we reserve our client’s rights in their entirety, and in particular advise that should any information of a defamatory nature be published, our client will consider legal steps.”

However, in September 2022, law firm Langenhoven Pistorius Modihapula denied that Alexandrou’s vehicles were financed with money from SME Bank.

Liquidators said car dealer Daytona Pty Ltd received more than N$10 million.

According to the liquidators, Justin Divaris of Daytona Holdings has not provided any explanation for the receipt of the money, nor proof that the money was received in payment from or on behalf of the vehicle recipients.

“Divaris and Daytona Holdings have not provided an explanation in respect of the discrepancies between their version and those of the vehicle recipients,” said the liquidators.

A separate case for Divaris and Daytona Holdings has been opened against them by the liquidators.

Legal representative for Daytona Pty Ltd, Alan Allschwang told The Namibian this week the company is aware of the matter and will assist the authorities if requested to do so.

“Several aspects of the matter directly or indirectly feature in other legal proceedings and as such are sub judice. In these circumstances, it would be inappropriate to comment thereon,” Allschwang said.

Allschwang said Divaris is not a director of Daytona.

“This fact was not initially appreciated by the liquidators of SME Bank who later, after being apprised of the correct position, withdrew all claims against Divaris, and paid his costs.”

*This article was produced by The Namibian’s Investigative Unit. Send story tips via your secure email to investigations@namibian.com.na