By Nghiinomenwa Erastus | 21 April 2020

THE lack of coordination and inaction by key financial and law enforcement agencies is hampering Namibia’s fight against the flow of dirty money in the country.

There is now a call to create a centralised government unit to patrol illicit financial flow in the country.

The police admitted to The Namibian this year it lacks a centralised portal to track finalised cases, cases under investigation or individuals and police being prosecuted.

The Financial Intelligence Centre (FIC), a specialised national agency responsible for detecting financial crimes in Namibia, flagged 254 potential financial crimes that were passed on to state authorities between January 2019 and February 2020.

During the same period, various banks and other financial institutions submitted 1 106 suspicious transaction reports (STR) and 236 suspicious activity reports (SAR) as red flags to the FIC for further scrutiny.

However, authorities could not provide updates on what has been done to those red-flagged reports.

They remained mute on the progress they have made and how they have used the FIC’s actionable intelligent products.

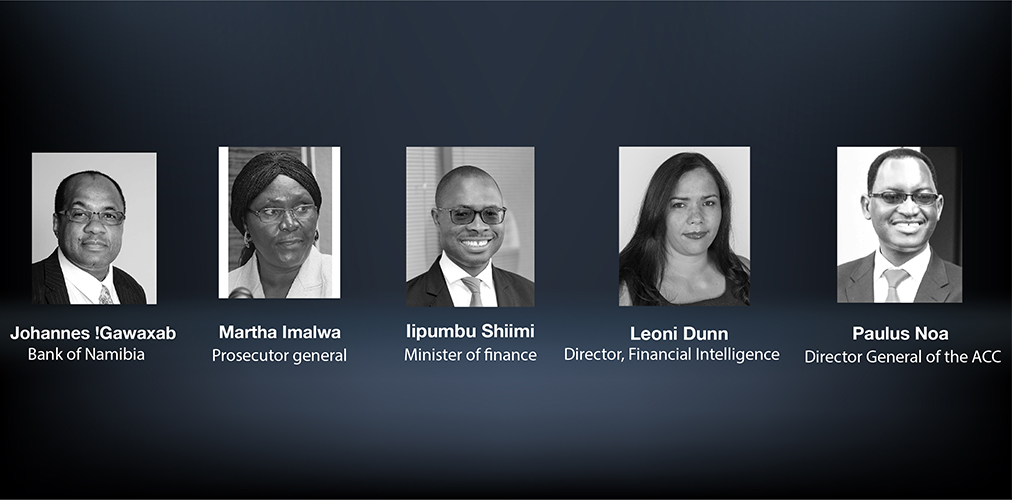

Authorities such as the Bank of Namibia’s FIC have been accused of turning a blind eye to the flow and transfer of dirty money in and out of Namibia.

Examples include how more than N$300 million disappeared from the now defunct SME Bank and unfolding fishing scandal that involved the transfer of close to N$175 million from a national fishing company to politicians and their friends.

National police spokesperson, Kauna Shikwambi, told The Namibian no data was compiled to provide feedback on the use of FIC intelligence, as they have a manual system.

This means the police cannot tell how much of the intelligence information they acted upon; how many cases went to court or were litigated; how many are under investigation or finalised, and how many individuals and companies have been prosecuted/fined.

Namibia’s tax agency has also been accused of failing to spot how private companies are dodging taxes and robbing the government of millions.

In an interview with The Namibian, the Inland Revenue commissioner, Justus Mafongwe, agreed they receive actionable intelligence from the FIC and some of their audits result in FIC red flags showing potential tax evasion.

Despite that, Mafongwe said red flag cases “are selected for audit based on risk, potential revenue yield, and cost-benefit analysis as we do not have enough resources to audit every case”.

He added they do not use all actionable intelligence from the FIC, as they still have to audit other cases not reported by the centre, given the taxpayer population is close to 800 000.

It is against this background that two financial experts called for tighter laws and coordination between financial and law enforcement institutions.

Meanwhile, Anti-Corruption Commission (ACC) director-general Paulus Noa said they do not have the mandate to investigate direct money laundering and tax evasion, pointing to the police, while tax evasion is forwarded to the Receiver of Revenue under the Ministry of Finance.

“However, money laundering investigations only form part of the corruption cases being investigated whenever those specific corruption cases involve money transactions,” he said.

The ACC affidavit on the ongoing Fishrot corruption case against high-ranking government officials highlighted how millions of dollars were channelled into the mainstream economy under the guise of consultation fees through clearing houses from offshore companies.

WORRYING

A professor in financial mathematics at the University of Namibia, Vijayakumar Kandaswamy, says the lack of progress on FIC red-flagged cases was “worrisome”.

He advises the country to come up with a unit that specifically looks at tax-evasion and money-laundering matters.

“The Bank of Namibia is one entity that can assist by being transparent about large transactions by individuals and organisations, and investigate them via the special unit,” he says.

A risk management lecturer at the University of Namibia, Samuel Nuugulu, says the number of flagged transactions highlighted loopholes and weak structures that were supposed to prevent illicit transactions such as money laundering and tax evasion.

He says the direct economic impact of illicit flows cannot be underestimated, as it drains the country’s foreign reserves, causes high inflation and reduces tax collections.

In most cases, the effect is not directly felt by those at the top, but by those at the bottom, he said.

“Strong institutions will eventually compel individuals and companies to engage legally, deal honestly, as well as report and pay their taxes and dues in accordance with our existing laws,” he said.

*This story was produced by The Namibian. It was written as part of Wealth of Nations, a media skills development programme run by the Thomson Reuters Foundation in partnership with the Institute for the Advancement of Journalism. More information at www.wealth-of-nations.org. The content is the sole responsibility of the author and the publisher.