By Shinovene Immanuel and Tutaleni Pinehas | 10 July 2020

FISHROT accused James Hatuikulipi has over the past five years bought houses like someone picking goods off a supermarket shelf, according to information The Namibian discovered through the Deeds Office and people who know him well.

Hatuikulipi’s property splurge coincided with the timeline of Namibia’s biggest corruption scandal.

His cousin Tamson ‘Fitty’ Hatuikuliupi (39) also saw a substantial increase in his property portfolio – from two properties to 22.

This was especially evident following Fitty’s 2011 marriage to Ndapandula, the daughter of Bernhard Esau, who was fisheries minister from March 2010 until the Fishrot scandal led to his arrest in November 2019.

Investigation documents show that ‘Fitty’ Hatuikulipi is accused of receiving N$70 million in kickbacks from an Icelandic seafood company.

During a bail application this week, Fitty claimed he is worth N$53 million. His father-in-law Esau, said during their joint court appearance for bail this week, his assets amount to N$23 million.

Last year alone, Fitty and his wife spent at least N$8 million on six residential properties, documents at the Deeds Office reveal.

The Hatuikulipis’ spending on property points to a trend among those accused of benefiting from the spoils of the Fishrot scandal.

Those who know James Hatuikulipi estimate that the value of his property portfolio rose sharply to well over N$100 million in four years.

This includes a farm about 100km east of Windhoek, a Cape Town house, apartments in Namibia and abroad, in addition to his main dwelling at the Finkenstein estate 12 kilometres outside Windhoek.

While reviewing hundreds of deeds documents, The Namibian discovered properties owned by five of the Fishrot suspects that had not been flagged by the Anti-Corruption Commission of Namibia (ACC).

The Namibian investigation, which spanned seven months, focused on property bought between 2011 to 2019 – the period during which the alleged corruption took place.

Deeds and affidavits The Namibian could directly link to those embroiled in the Fishrot scandal show they bought 33 commercial and residential properties in Namibia for more than N$70 million.

The value is based on documents The Namibian could verify with the registrar of the Deeds’ Office and are likely lower than market prices.

The Namibian has learnt that several properties were bought through trusts and companies.

These [the ones in trust and private companies] property portfolios could be valued at more than N$250 million if construction and upgrade costs are included.

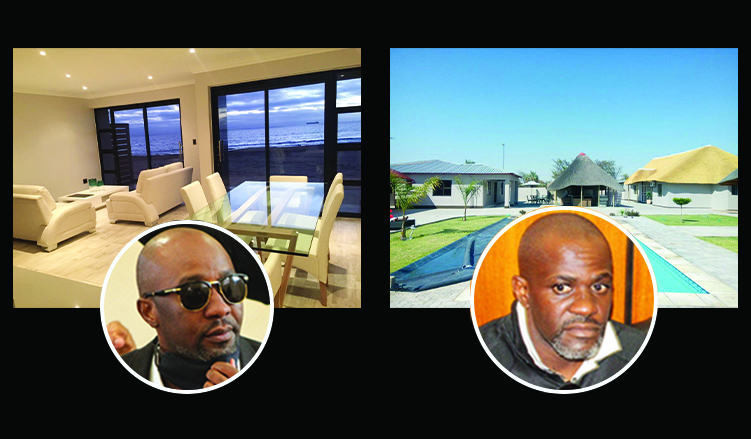

The above amounts exclude two luxury holiday homes in Cape Town linked to James Hatuikulipi and Sacky Shanghala, another of the two former ministers embroiled in the Fishrot corruption scandal.

The Namibian understands that two of the suspects were in the process of buying holiday houses in Dubai, England and Spain.

Shanghala’s property portfolio is largely linked to James Hatuikulipi’s assets through Cambadara Trust and other other companies.

The Namibian does not have evidence that directly links Fishrot proceeds to the property purchases but at least two of them were bought through companies that allegedly received bribes from Icelandic seafood company Samherji.

Global anti-corruption watchdogs like Transparency International say buying property is a favourite method to launder ill-gotten gains.

“When corrupt officials take large bribes, embezzle funds or otherwise steal money from the countries they are meant to serve, the money usually has to be cleaned before it can be enjoyed,” the watchdog said.

ABOUT FISHROT

Fishrot is one of the biggest corruption cases in Namibia and arguably the most far-reaching in terms of exposure. Among others, it led to the arrest of two sitting ministers, the first drastic step of its kind the authorities have taken since Namibia’s independence.

It involves allegations of money laundering, fraud, bribery and corruption involving top ministers, their families, friends and political cronies and the Icelandic seafood company, Samherji.

Namibia’s Anti-Corruption Commission disclosed in November 2019 that it had opened a “docket” in 2014 to investigate sophisticated corruption in the fishing industry, following a report by The Namibian titled ‘Esau appoints relative to chair Fishcor’.

Fishcor is a state-owned company through which most of the schemes were facilitated.

The ACC played down media reports and other allegations until October last year when news organisations such as Icelandic National Television in Iceland, Qatar-based Al Jazeera and The Namibian published details of the schemes with the help of whistleblower Johannes Stefansson.

The case then unravelled fast and saw the resignation of fisheries minister Esau and minister of justice Shanghala.

Shortly afterwards, the two ministers were arrested along with Investec Asset Management Namibia managing director James Hatuikulipi and Investec Asset Management Namibia client manager Ricardo Gustavo.

Investec Asset Management has now been renamed Ninety One Asset Management Namibia.

Two of James Hatuikulipi’s relatives – his cousin Fitty and Pius Mwatelelo – were also arrested.

Fishcor later suspended its chief executive, Mike Nghipunya, who was subsequently arrested in February this year. James, Esau, Gustavo and Nghipunya have denied guilt on charges of bribery and money laundering.

The state charges that the group benefited from N$175 million in corrupt money.

Industry sources estimate the web of corruption and kickbacks could amount to more than N$2,5 billion.

All six main suspects are in jail awaiting trial.

PROPERTY FIXER

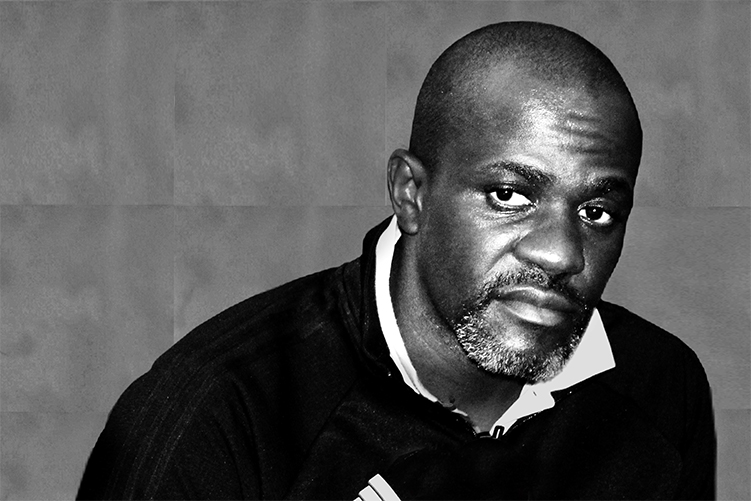

Investigators and friends have pinpointed James Hatuikulipi (45) as the ‘mastermind’ of Fishrot, at least from an administrative and managerial point of view.

Hatuikulipi is a long-term close friend and business partner of former justice minister Shanghala, the political cog in the wheel.

The ACC said N$120 million from the Fishrot scandal was sent to Hatuikulipi’s company in Dubai.

Most of James Hatuikulipi’s real estate property is owned by a trust or his companies.

He and Shanghala are trustees of the Cambadara Trust, which bought Finkenstein No 526, or erf 12, for N$1 million in 2012. The property measures about 9 000 square metres.

Sources said Hatuikulipi started building “his dream house”, valued at N$10 million, at Finkenstein in 2015. By 2016, he had moved in and rented out his Ludwigsdorf house.

Hatuikulipi then made major renovations to his village house at Engela – adding more rooms, a pool and a lapa.

He allegedly also bought a N$4 million house at Sunset Links, a golf estate in Cape Town. He leases another golf estate to Shanghala, people close to him said.

In 2016, he bought a property at Ongwediva in northern Namibia.

The following year, sources claim he carried out extensive renovations to his childhood home in Katutura’s Donkerhoek location.

That same year a company called Olea Investment bought two farms for N$11,5 million, deeds documents show.

Farm Gunsbewys measures around 3 000 hectares, while farm Dixie is 2 000 hectares.

Hatuikulipi and Shanghala are directors of Olea and own 50% stake each.

They immediately started building one of the most luxurious farms in the Dordabis area and it was completed within a few months, sources said. It is the same farm where

Hatuikulipi and Shanghala were arrested on 27 November.

Hatuikulipi owns Erf 1207 at Otjiwarongo, measuring 1 029 square metres, which he bought for N$2,5 million.

It is registered under Erf One Nine Zero Kuisebmond, a company owned 100% by Hatuikulipi. Erf One Nine Zero Kuisebmond is said to have received more than N$3 million in kickbacks from Samherji.

Some of Hatuikulip’s property is linked to David Izak Moller, a business associate.

Moller is the managing director of D&M Rail in which James Hatuikulipi owns shares. D&M Rail was controversially given a state railway maintenance contract, costing taxpayers N$100 million a year in perpetuity.

Shanghala, as attorney general, declared that the contract was above board despite it being awarded without public bids.

D&M Rail was also given a questionable N$150 million railroad repair tender from the Ministry of Works and Transport in 2012.

In 2013, Hatuikulipi and Moller acquired land in Olympia estimated to cost N$2 million and measuring 1 500 square metres.

They also owned a 1 320-square metre property in Academia. In 2015, it was sold for N$1,5 million to AL Investments No 6, a company linked to Hatuikulipi’s cousin Fitty.

According to Moller, the Academia property was bought with the proceeds of another property deal, and the Olympia property through a loan from Bank Windhoek.

Moller confirmed that James Hatuikulipi is still a shareholder in D&M Rail – which continues to benefit from state railway deals.

“I’m sure you can appreciate that in view of his [James] continued incarceration, his role going forward is not clear as yet,” Moller said.

Read more on the spoils of Fishrot: son-in-law (part 2)

* This article was produced by The Namibian’s investigative unit with support from the Organised Crime and Corruption Reporting Project (OCCRP).

* Fact checked by: Victoria Wolf. Additional reporting: Eliaser Ndeyanale.