By Shinovene Immanuel | 14 November 2017

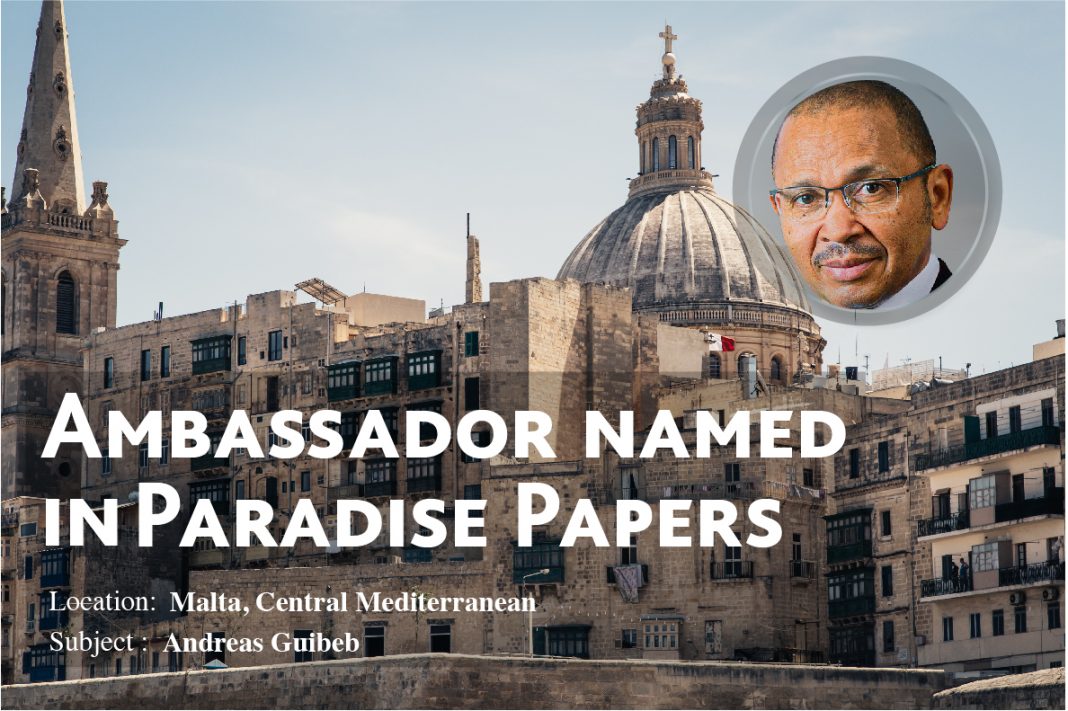

NAMIBIA’s ambassador to Germany, Andreas Guibeb, served as a director of two companies registered in Malta, a European island known for helping tax avoiders, money launderers, drug traffickers, kleptocrats and shady businesses.

Paradise Papers, a global leak which details methods used by rich and powerful countries and executives to hide wealth – sometimes from their spouses – and avoid paying taxes in countries from where they made their money, mention Guibeb.

The confidential documents were obtained by the German newspaper, Süddeutsche Zeitung, and shared with the International Consortium of Investigative Journalists (ICIJ) to facilitate the investigation which involves over 100 media organisations around the world.

Guibeb served as a director and shareholder of two companies which were registered in Malta by Appleby, a Bermuda-based provider of offshore legal services.

Appleby, established in 1898 in the British colony of Bermuda, was exposed last week for assisting several companies and individuals to hide their money in secretive territories.

Some of Appleby’s customers are politicians for whom avoiding unwanted attention is crucial.

Guibeb held several senior government positions for many years. He was Namibia’s first foreign affairs ministry permanent secretary in 1990.

He was also Namibia’s high commissioner to Zambia in the 1990s, and then Air Namibia managing director from 1996 until 1999.

According to his LinkedIn account, he later started Guibeb & Associates which specialises in marketing, tourism and lifestyle.

President Hage Geingob appointed Guibeb in December 2015 as the ambassador to Germany.

Part of his ambassadorial job in Germany includes overseeing Namibia’s diplomatic interests in countries such as Turkey.

Leaked documents show that Guibeb was involved in offshore dealings two years before his diplomatic posting.

He has, however, denied any wrongdoing to The Namibian.

The documents show that Guibeb was a director and shareholder of two offshore businesses in Malta, an island situated in the central Mediterranean between the north African coast and Sicily, near Italy.

Appleby registered the companies represented by Guibeb in 2014.

Just last week, The Namibian reported on how Appleby helped an international fishing company to avoid paying taxes in Namibia.

Guibeb served as a director and shareholder in Green Town International Limited, and AFG International Business Bureau Limited.

Green Town International Limited, was formed on 8 July 2014 to, amongst others, work on construction, leasing, consultancy and public relations work.

Green Town International Limited’s directors and shareholders include Guibeb, German national Mehmet Serif Alpteken, two Italians Mauricio Ancora and Felice Ferrante as well as a Turkish national based in Germany, Askin Nafiz Seyhan.

Seyhan’s LinkedIn profile says he is a business consultant, and has interests in green energy, real estate and project funding.

The second firm, in which Guibeb served as a director and had shares, was AFG International Business Bureau Limited.

According to the Malta Financial Authority’s website, AFG International was registered in August 2014.

Its directors and shareholders include the same ones featured in Green Town International – Guibeb, Ferrante and Ancora – and five others.

The other shareholders are French national Joel Stephanie Nioumbiap Nzali, Turkish national Askin Nafiz Seyhan, Italian nationals Fabrizio Orlandini, Chiara Orlandini and Roberto Bizzari.

The Namibian could not establish the background of the majority of Guibeb’s partners in AFG International, but Italian citizen Ancora had posted on French business social network site Viadeo that he is still working for AFG International.

According to the United Kingdom’s Company House, an entity that registers companies, Nzali also runs Batsela Consulting Limited and Ed Asset Management in London, while Alpteken is a financial director.

While having an offshore company is often legal, the secrecy in those areas attracts money launderers, drug traffickers, kleptocrats and others who want to operate in the shadows.

Guibeb’s presence in the Paradise Papers’ leak puts question marks about his business dealings, especially when the law firm that helped Guibeb’s companies has a reputation for helping rich individuals to avoid paying taxes and hide millions away from government authorities.

Guibeb said he resigned from the two companies last year, and that the companies have been inactive since registration.

“The companies in question never started trading,” he told The Namibian this month.

Guibeb said people and companies do not have to register in Malta to avoid paying taxes.

“Even companies registered in Namibia avoid paying taxes by hiding or under-declaring their taxable income,” he stated.

According to him, high-income earners use offshore facilities to avoid paying higher taxes in countries in which they do business.

The ambassador said public officials should not engage in offshore businesses.

“I have practised as a private person with no government involvement between 1998 and December 2015,” he noted.

Guibeb did not respond to specific questions about the identities of his co-directors in the two offshore companies.

“You are asking me to account about your imaginations about matters that belong to my private life when I had no public responsibility before 2016,” he said.

He, instead, questioned why he is being implicated in this story if the only justification is that he was a private individual who had no public responsibility at the time he accepted a board membership in Malta-registered companies.

“What public interest does it serve that one of many Namibians that you have not [allegedly] researched hold board memberships or shares in many favourable tax jurisdictions around the world?” he asked.

The ambassador said the companies he was part of did not commit any crimes.

* This article was produced by The Namibian’s investigative unit, in partnership with the International Consortium of Investigative Journalists (ICIJ).