By Shinovene Immanuel | 24 October 2014

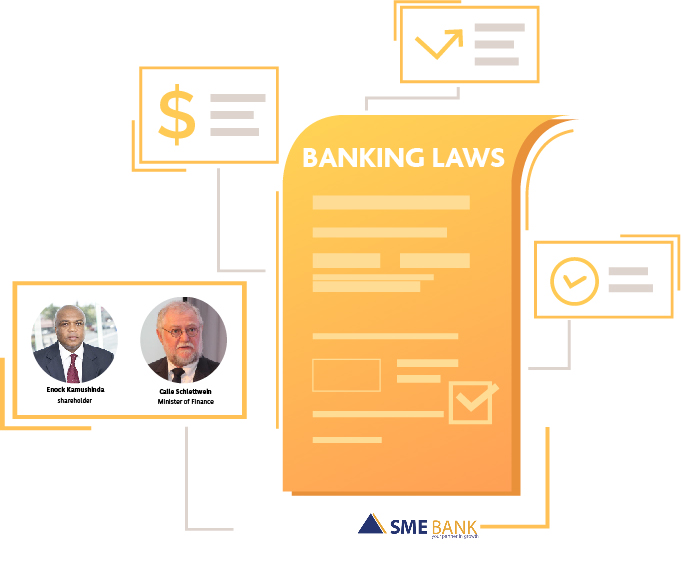

THE Bank of Namibia has allowed the SME Bank to disregard the country’s banking laws and regulations with impunity.

The Namibian has learnt that the SME Bank has ignored the central bank’s instructions, and also not bothered to observe banking laws in the country.

Sources said the bank has not produced audited financial statements in compliance with the banking laws of the country. By not submitting audited financial statements on time and not publishing them in a newspaper, the SME Bank has been in contravention of section 47 of the Banking Institutions Act of 1998.

Bank of Namibia sources told The Namibian that the SME Bank has been meeting its legal requirements by furnishing it with financial reports, monthly, quarterly and yearly.

However, this contradicts trade and industry minister Calle Schlettwein’s version of the situation.

Schlettwein said the SME Bank had problems with its previous auditors and had to let them go without completing the financial statements, adding that the bank took long to appoint replacement auditors because its policy dictates that auditors can only be appointed at an annual general meeting.

The fact that the SME Bank’s audited financial statements have not yet been published in the media is also in contravention of Section 47 of the Banking Institutions Act.

Besides failing to comply with banking laws and requirements, the SME Bank’s private shareholders allegedly tried to change the Bank of Namibia-approved shareholding structure and bring in new shareholders through the back door.

Documents seen by The Namibian show that by February this year, businessman Enock Kamushinda was still a 35% shareholder in the SME Bank. This was in contradiction of the central bank’s conditions for approving the SME Bank’s licence. The central bank’s conditions are that Kamushinda should hold only a 5% stake in the bank.

In a letter dated 26 February 2014, BoN governor Iipumbu Shiimi demanded an explanation from SME Bank chairman Frans Kapofi why Kamushinda still had a higher shareholding than what was sanctioned by BoN.

“The Bank (BoN) would like to obtain clarification why Mr Kamushinda made capital contributions in excess of the required 5% interest that he was allowed to hold. Moreover, why do the official records of the SME Bank show that Mr Kamushinda holds an interest of 35% in the banking institution?

“In this regard, BoN would like to obtain a written explanation by not later than 7 March 2014 why this situation transpired at your banking institution,” read Shiimi’s letter.

Kamushinda refused to comment on details about the SME Bank, asking whether Bank of Namibia is now in the business of issuing bank shareholding in the media.

“Please talk to Kapofi, don’t speak to me,” he said.

By April this year, the SME Bank had not rectified the shareholding structure to comply with BoN directives.

In a letter addressed to the SME Bank dated 14 April 2014, BoN head of banking supervision Romeo Nel, stated that the SME Bank used a wrong shareholding structure in its 2013 business plan and in its 29 November 2013 board minutes.

In these documents, Kamushinda was listed as a 35% shareholder and Nel demanded that the SME Bank should rectify “the anomaly” and stick to the approved structure.

The Namibian last year reported that the central bank made conditions to cap Kamushinda’s shareholding in the SME Bank because he did not pass the fit and probity test.

Despite not passing the fit and probity test for being a major shareholder, he was still allowed to serve on the Bank’s board of directors and on its board audit committee.

When plans to allow Kamushinda a 30% stake did not materialise, SME Bank’s technical partners Metropolitan Bank of Zimbabwe (MetBank) again attempted to bring in new shareholders through the back door, documents show.

The documents indicate that MetBank wanted to offload its 30% shares to Loita Finance Holdings Limited and Crudge Investments Private Limited. The two entities are not registered in Namibia.

The proposed new shareholders were rejected by BoN and the regulator ordered that the two entities should follow BoN procedures to apply for shareholding independently.

This would subject the two companies to vetting.

MetBank’s representatives in Namibia, Shikongo Law Chambers and Shangelao Capital, informed Bank of Namibia in March last year that MetBank no longer wanted to take up shareholding in the venture because the Zimbabwean bank was facing problems in pumping money into the institution.

Besides that, MetBank alleged that acquiring shares in the SME Bank would also put the Namibian institution under the supervision of the Reserve Bank of Zimbabwe.

This would mean that the Reserve Bank of Zimbabwe will also have to be consulted on major decisions made by the SME Bank.

MetBank appears to have had another change of heart and indicated in May this year, that it now wishes to take up the 30% stake.

BoN sources said that the MetBank was backtracking on taking up the shareholding because it feared government was not going to pump money into the venture.

Trade and industry minister Calle Schletwein, told The Namibian a week ago that a decision was made, at an annual general meeting two months ago, that MetBank takes up shareholding and invest the required funds to make up its 30% stake proportionate to what government invested as its share capital.

BoN sources said that the SME Bank was not reprimanded for the transgressions, while the central bank has consistently insisted that the SME Bank’s operations are above board.