By Shinovene Immanuel | 18 November 2016

NEW state owned company Namib Desert Diamonds (Namdia) has deliberately sold the country’s diamonds cheaply to Dubai – five times less than the price they eventually fetched in the Middle East.

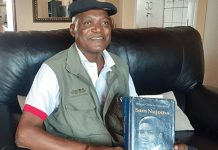

Namdia’s board chairperson Shakespeare Masiza did not respond to questions sent to him on Wednesday, but experts said the company has so far had two transactions of diamonds, selling to companies in Dubai since it started operating in August this year. Namdia used a former De Beers middleman now based in Dubai to facilitate the sale of Namibia’s diamonds there.

Masiza admitted last week that Namdia sold diamonds – estimated to be worth around N$2,1 billion – to Dubai-based companies. He refused to say how much the diamonds were sold for or to provide the names of the buyers, citing confidentiality. But The Namibian understands that Namdia sold the diamonds cheaply, despite the higher valuation of those diamonds in Namibia.

In one incident, The Namibian is told that a parcel worth US$2,7 million (more than N$30 million) was sold in Dubai by a consultant below its real value.

People familiar with the industry told The Namibian this week that Namdia sold the diamonds here for US$500 (around N$7 100) a carat. But the same diamonds were then sold on for US$2 500 (N$35 600), per carat.

Namdia, a 100% state-owned company, born out of an agreement between the government and diamond giant De Beers earlier this year, was formed to “test” whether Namibia was getting the best income through the multinational by going onto the open market.

The Namibian understands that Namdia has contracted Dubai and London-based diamond dealer Neil Haddock, who has also worked for De Beers and its Namibian subsidiaries. Using Haddock as a consultant has raised questions about a conflict of interest, and whether Namdia can really claim to test the market outside of De Beers’ pricing system.

On top of being secretive about how Namibian resources are being sold, the diamond parastatal has largely been a briefcase parastatal which has outsourced most of its work to private companies and individuals like Haddock.

Some people raised red flags about the decision by Namdia to use Haddock as their marketing and sales consultant because it will defeat the alleged price discovery mission. This is because Haddock works for the same institutions Namdia wants to be independent from.

Haddock owns Global Diamond Tenders, a company that reveals on its website that he is “an independent valuer/adviser to the government of Namibia and in Angola”. Questions sent to him yesterday were not responded to.

Haddock is not new to controversy.

The Mail and Guardian reported two years ago that the Zimbabwean government was not happy about his role in the country’s sale of diamonds to Dubai. Haddock was allegedly paid US$580 000 (N$8,2 million) in consultancy fees for handling Zimbabwe’s diamond auction in Dubai.

Zimbabwe’s mines minister Walter Chidakwha confirmed in a 2014 report that they were not happy with Haddock’s work. “In the long run, the idea is to do away with these middlemen, as they charge us a handling fee. The Antwerp fees were more expensive than Dubai’s, but we need a facilitator to help with securing dates on the international calendar for a slot when it is less busy,” said Chidakwha.

ANOTHER PARCEL

Diamond export data seen by Khadija Sharife from the Organised Crime and Corruption Reporting Project – an investigative journalism organisation – showed alleged misinvoicing for a parcel of diamonds originating from Namibia in the second quarter of 2016.

She said the transaction of 1 362,8 carats which may have been a single transaction or multiple bundled transactions, was exported from Namibia to the European Union and onwards to the United Arab Emirates at a value of US$1,68 million (N$24 million).

The same volume was exported to India from the United Arab Emirates at a price of US$1,87 million. A difference of US$190 000 (N$2,7 million) was evident from the period when it was exported to Dubai and the price at which it was re-exported from Dubai to India, she said.

According to her, the diamonds were valued at over US$1 250 per carat on average. The company or companies involved were not disclosed on the data, and there is no evidence that Namdia is involved, but they were sold a few weeks after the parastatal was formed.

“Usually, tax havens like Dubai provide a platform for subsidiaries of companies to repackage rough diamond parcels to ensure that profit-shifting between jurisdictions cannot be identified through granular data,” Sharife said.

Most rough diamonds travel through several different jurisdictions for the purposes of mixing parcels, showing them to buyers. But often, one company just moves diamonds through different places to manipulate price points. This parcel was sent from Namibia to the European Union, from the European Union to Dubai, and from Dubai to India.

“The use of shell companies and secrecy in the global diamond trade has become a key money laundering and tax avoidance vehicle. Unlike gold, diamonds have no external benchmarked value,” Sharife said.

Haddock is mostly based in Dubai, a location notoriously known for undervaluing diamonds from Africa.

Diamond experts said Dubai provides two advantages to people who want to be involved in dodgy deals: first is the ‘mixed origin’ Kimberley Process certificate that effectively removes the origin of the diamonds; second is the frequent re-invoicing of diamonds, which are exported from African countries at a lower price before being re-exported from Dubai at a higher price.

The Namibian has in the past reported how Namdia appears to be in the hands of a cartel of top politicians, senior state officials and their cronies who are strategically placed in the new parastatal to benefit from Namibian diamonds. Some of them are linked to top officials in the Presidency and the office of the attorney general.

News about the Dubai evaluations comes at a time that Namdia and the energy ministry are accused of disregarding national tender laws by hand-picking a company to valuate the diamonds from Namibia.

Now, sources said, there is an attempt by Namdia and energy ministry officials to cancel the tender issued to C-Sixty Investment, a company owned by businessman John Walenga and Tironenn Kauluma, which was hand-picked to evaluate diamonds from the new state-owned diamond firm.

Sources claimed that a group of business people in Namibia wants to be in control of the diamond supply, marketing and sale channels. And Walenga’s company appears to be one of the companies which is set to be targeted in order to wrestle the chain in favour of a well-known Namibian wheeler-dealer and his friends.

– This article was produced by The Namibian’s investigative unit. Email us: investigations@namibian.com.na