• SONJA SMITH

FORMER Ovaherero paramount chief Kuaima Riruako’s children are battling to finalise their father’s estate.

The battle includes concerns about profits from a fishing company he co-owned.

Riruako died in June 2014, ending his 35-year reign of the traditional authority at the age of 79.

He became the paramount chief after his cousin Clemens Kapuuo was assassinated in 1978.

His estate, seen by The Namibian, provides insight into the former leader’s assets valued at N$3,2 million.

This includes cattle, cars, and firearms.

Riruako, a former member of parliament, did not leave a will that could be used to disburse his assets.

He is survived by his wife, Enesia Riruako, and 16 children.

His family says they are struggling to finalise his estate – eight years after his death.

They say they requested the financial statements of a fishing company he co-owned, so they can be paid an estimated N$1,3 million.

Riruako’s son Brian Riruako last week said these funds have not been paid into the trust yet.

“It has been eight years, and we are still waiting. The company has no cooperation with the lawyers who are assisting the family to speed up the process,” he said.

“Three of my siblings who are also beneficiaries have died while waiting for their inheritance,” Brian said.

The Namibian has seen a letter by the master of the High Court directing Riruako’s business partners in the company to disclose financial statements.

“Our office has been informed that the late chief Kuaima Riruako was a member of Omahua Investment, previously known as Omahua Investment Close Corporation,” the letter dated 17 August 2022 said.

The master of the High Court gave the company’s members seven days to respond.

“We hereby request that you, as a matter of utmost urgency, disclose all financials, dividends and monies due and accruing to the above estate in respect of the company,” the letter said.

The letter is addressed to Hollard Insurance manager Sam Kauapirurua – one of the partners in Riruako’s company.

Sources say there is a fallout between the partners in the company and Riruako’s family.

Kauapirurua recently confirmed that all members of the company have been paid their dividends – except Riruako.

He said the company has sought legal advice.

“Let’s wait for the lawyers to advise us. If I start talking about dividend payouts now, I could end up contradicting myself,” Kauapirurua said.

FISHING RIGHTS

Omahua Fishing Investment CC was registered in 2008 by Riruako alongside Kauapirurua, former parliamentarian Arnold Tjihuiko, lawyer Patrick Kauta, and former secretary of the Ovaherero Traditional Authority Bethuel Katjimune.

Other members in the company include Elsie Mbako and Jan Kangombo, both now deceased.

Riruako held a 30% stake in the fishing entity.

The company first became a fishing rights holder in 2011.

Last year, it emerged as a beneficiary of a new round of fishing rights.

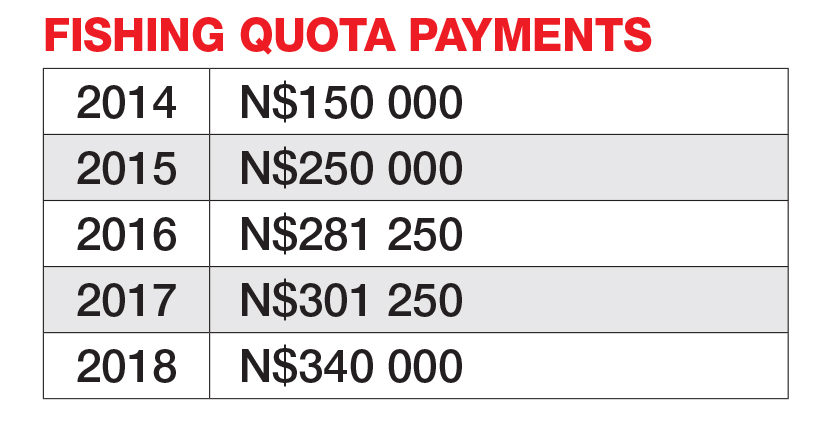

The company’s financial statements from 2014 to 2018 show it owes Riruako dividends worth N$1,3 million.

The payments include: N$150 000 for 2014, N$250 000 for 2015, N$281 250 for 2016, N$301 250 for 2017, and N$340 000 for 2018.

A liquidation and distribution statement seen by The Namibian shows that Riruako’s total estate value currently stands at N$1,7 million.

This includes N$1,5 million the company owes him to repay a loan he had granted with 30% interest.

That could bring the total estate to over N$3,2 million. It could be more, if dividends paid out between 2019 and 2021 are to be included.

Kauta explained the delay is caused by the estate executor.

Documents show Enesia is the executor of Riruako’s estate.

“I managed the CC before it was changed and gave the executor of the chief’s estate the financial statements of the CC at the time. The executor failed as required by the Close Corporation Act to take members’ interest in Omahua Investment CC,” Kauta said.

“I went an extra mile and registered Hallie Investment 505 CC for the chief’s children to take advantage of the conversion and become shareholders with the wife after conversion. After conversion I am no longer in charge of Omahua,” he said.

“However, after receipt of your disturbing message yesterday, I spoke to those in charge and all would be solved by Tuesday,” he said.

Questions sent to Tjihuiko and Katjimune went unanswered.

RIRUAKO’S estate

Riruako and Enesia married in community of property in 1988, allowing Enesia 50% of the estate.

The remaining 50% is to be shared equally among his children.

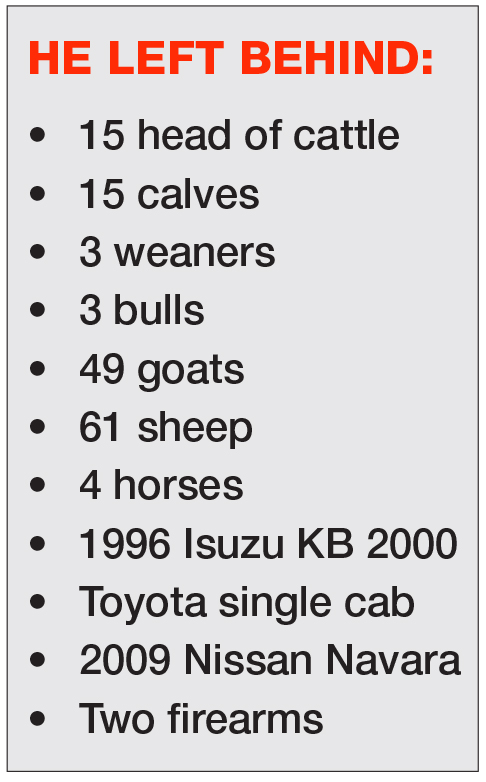

At death, Riruako had 15 head of cattle, 15 calves, 13 weaners, three bulls, 49 goats, 61 sheep and four horses.

The livestock have since been sold and some have died.

It’s not clear how much the livestock were sold for.

He had a 1996 Isuzu KB 2000, a bakkie with a broken canopy, a Toyota single cab, and a 2009 Nissan Navara.

The four vehicles were sold for a total of N$50 000, the statement shows.

Riruako had two bank accounts, one at Standard Bank with N$78 961, and one at FNB with N$1 086.

Lawyer Nawala Kamati-Unger, the assistant executor of Riruako’s estate, declined to comment.

“I do not make statements to the media on ongoing cases such as this,” she said.

WHY A WILL?

Wills in Namibia are regulated by the Namibian Wills Act 7 of 1953, as well as by customary law.

Where there is no will, the estates follow a law called the Intestate Succession Ordinance 12 of 1946.

That allows magistrates to handle estates of less than N$100 000, while larger ones are handled by the Office of the master of the High Court.

Sanlam legal consultant Marike Jacobs says when an individual leaves no will, their estate may be distributed without considering the deceased’s particular wishes.

“With intestate succession you also lose your ability to nominate an executor of your choosing, as well as trustees to take care of the inheritance of minors in terms of a testamentary trust as regulated by the rules set out by you, since all of these must be stipulated in your will,” she says.

“If you die intestate, your heirs would have to nominate an executor among themselves, and this executor would have to appoint an agent who is recognised by the Master of the High Court to administer estates,’’ she says.

“As far as the inheritance of minor heirs goes, the funds must be paid over to the Guardians Fund, as regulated by the master of the High Court, and be administered in favour of your minor heirs until they reach 21 years of age.”