By Tileni Mongudhi | 12 February 2021

THE former head of the Namibian Police’s anti-money-laundering unit received a N$350 000 loan from the SME Bank while investigating the bank for alleged money laundering.

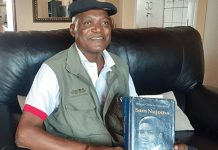

Due to this, deputy commissioner Rector Sandema, who at the time was the detective chief inspector heading the anti-money-laundering unit, is now in the spotlight.

Information has come to light that Sandema may have been involved in a conflict of interest, amid concerns that investigations into the SME Bank were delayed by at least two years.

At the same time about N$350 million was reportedly stolen from the bank by former co-owner Enock Kamushinda, who is accused by liquidators of committing “grand fraud” at the bank.

A Zimbabwean businessman, Kamushinda allegedly shipped most of the stolen millions out of the country.

He also allegedly passed on some of the dirty money to politically connected individuals, such as businesswoman Tania Hangula and ministerial assistant Esau Mbako.

WARNING

So far, no one has been arrested in connection with the alleged SME Bank theft.

Evidence seen by The Namibian shows the police – an institution tasked with investigating alleged money laundering – was tipped off on irregularities on 28 May 2014 through an anonymous letter.

A whistleblower provided specific details of the misdeeds, including total amounts of money laundered and individuals’ names.

“[The] SME Bank is on the verge of causing international embarrassment due to being used as a conduit to launder money by Zimbabwean nationals,” the letter stated.

The whistleblower alleged that money was being siphoned from the bank through inflated maintenance and repair jobs, money laundering and the abuse of bank funds.

Other concerns were that SME Bank money was being stolen through fake transactions and investments.

This included N$4 million the bank paid for the use of Mastercard facilities through the Metropolitan Bank of Zimbabwe (MetBank), which was in fact stolen.

The letter listed then-SME Bank chief executive officer Tawanda Mumvuma, chief financial officer Joseph Banda and treasury general manager Alec Gore as those responsible for the transaction.

NO ACTION

The police’s commercial crimes investigations division stamped the whistleblower’s letter as received on 1 October 2015.

What followed appears to confirm the suspicion that the police may have turned a blind eye to the theft at the bank.

Some suspect the N$350 million may not have been stolen if the police had acted earlier.

Evidence seen by The Namibian shows that the police’s anti-money-laundering unit head at the time, Sandema, registered his company – Shower Investments – on 7 October 2015.

This was a week after the police’s commercial crime department received the tip-off from the whistleblower.

Sandema then made contact with the SME Bank’s management about the allegations in the anonymous letter.

The SME Bank management wrote to Sandema on 22 December 2015, providing a list of employees in the bank’s finance department.

SME Bank is said to have followed that up with additional communication to Sandema in

January and February 2016 in response to allegations made in the anonymous letter.

Sandema appeared to eye a loan from the same institution he was probing.

On 21 June 2016 Sandema’s Shower Investments opened an SME Bank account.

Two months later, on 17 August 2016, his company received a N$350 000 loan from the bank.

Since then, Sandema has been promoted to deputy commissioner.

In around 2018, he was moved to the Isreal Patrick Iyambo Police College.

It is not clear why he was transferred.

The police public relations department did not answer questions about the move or whether the police were aware of the conflict of interest while investigating the failed SME bank.

Sandema declined to comment when approached this week.

“Please liaise with the relevant institutions, as I believe all information you are asking for is available at such agencies,” Sandema said on Tuesday.

Nation police spokesperson deputy commissioner Kauna Shikwambi last week confirmed that the police are investigating how N$350 million was stolen from the SME Bank.

A case docket has been registered by the Anti-Money-Laundering and Combating Financing Terrorism Division – a division within the Criminal Investigations Directorate.

Shikwambi said the police’s money-laundering investigation only started on 14 November 2016, almost a year after Sandema made contact with the bank he was supposedly investigating.

Sandema’s company, Shower Investments CC, benefited from an SME Bank loan at the same time as the delay.

Shikwambi said last week that police investigations are progressing.

“Financial investigations are document intensive and complex, and therefore gradual,” she said.

Shikwambi said the investigations have not been completed yet, because of further instructions from the Office of the Prosecutor General involving foreign jurisdictions.

Sandema was arrested over alleged drunken driving in Windhoek last year. He made his first court appearance on three criminal charges in 2020.

The police and the Bank of Namibia have for years faced criticism for failing to stop the looting of the more than N$350 million from the SME Bank.

These institutions are accused of being reluctant to investigate alleged criminal activities at the failed bank, because politicians and politically connected business people could be implicated.

The Anti-Corruption Commission (ACC) has washed its hands of the SME Bank saga.

ACC spokesperson Josefina Nghituwamata last week said the ACC is not investigating SME Bank-related cases.

She said this was because the case resorts under money laundering.

The ACC has seemingly been trying to avoid investigating anything related to the SME Bank.

This is despite media reports in 2017 that ACC director general Paulus Noa vowed to get to the bottom of the saga.

He was also quoted as saying those involved would not be spared.