By Mathias Haufiku and Tileni Mongudhi | 14 July 2020

THE liquidators of the SME Bank are suing businesswoman Tania Hangula and ministerial assistant Esau Mbako to pay back N$7,4 million allegedly stolen from the now defunct bank.

Hangula, who is the Development Bank of Namibia’s board chairperson, received N$6,4 million which allegedly originated from the looted bank.

Mbako – minister of agriculture, water and land reform Calle Schlettwein’s executive assistant – said he got a N$970 000 loan directly from fraud-accused Enoch Kamushinda, who is accused of stealing taxpayers’ money and savings from the SME Bank.

Mbako is quoted in the court papers as saying he arranged a loan agreement with Kamushinda during 2010 in the lobby of the Windhoek Country Club Resort and Casino.

Hangula and Mbako served as president Hage Geingob’s assistants on separate occasions before he became president in 2015.

The SME Bank liquidators’ claims against the two are the first against high-profile persons hauled before the courts in one of Namibia’s biggest bank fraud scandals, involving close to N$250 million allegedly stolen from the bank for a clique of Namibian and Zimbabwean businessmen.

Now the curtain is being raised on some people accused of benefiting from alleged ill-gotten money from the SME Bank.

Documents filed at the High Court paint a picture of two individuals who cashed in to buy nice-to-haves with money meant to benefit small businesses.

Hangula, it is claimed in court documents, benefited around N$6,4 million she received from the SME Bank between 2015 and 2019.

SME Bank funds are said to have been used to buy her a N$1,2 million property at the Long Beach residential area between Walvis Bay and Swakopmund.

SME Bank loot was allegedly used to pay N$740 000 for Hangula’s E250 Mercedes-Benz vehicle.

Around N$1 million was allegedly paid to her in cash.

Liquidators Ian McLaren and David Bruni believe Hangula was paid through a consultancy agreement between her and the SME Bank from 2015 to 2019.

The liquidators are claiming the consultancy agreement was used as a conduit to transfer money stolen from the SME Bank into Hangula’s bank account and her company Umoja Trading.

CONSULTANT

The consulting agreement between Hangula and the SME Bank has been described as “obscure” in court documents.

This was because Hangula’s fees for the arrangement mainly came from third parties, in the form of people and entities linked to Kamushinda.

Such entities were allegedly used to channel the stolen money.

The liquidators say their investigations found that apart from not receiving the money directly from the SME Bank, Hangula never invoiced the bank for her payments, which according to them is evidence that she rendered no services to the SME Bank to warrant payments made to her.

“The defendant as an experienced businesswoman knew that no commercial bank could enter into such an agreement with any person, particularly without any written invoices being delivered to the SME Bank, before the SME Bank made payments to the defendant,” read the court documents.

The liquidators have also revealed that payments to Hangula were concealed and not disclosed in the bank’s financial records or to its auditors.

According to court papers, Hangula disputed the N$6,4 million she received from SME Bank, claiming she received only N$5,4 million in total.

Hangula entered into a consulting agreement as a “fundraiser” with the SME Bank during 2012.

She was going to be paid a monthly fee of N$50 000 and was also entitled to a 0,5% commission.

The SME Bank undertook to pay her travelling expenses as well as a travelling allowance when conducting her fundraising endeavours.

Despite the agreement having been penned during 2012, Hangula only started receiving her monthly payments in 2015.

The Namibian’s investigation into the SME Bank, which was allegedly used as a slush fund for Hangula and other politically connected individuals, shows how money meant to support upcoming businesses was used to maintain the personal lifestyles of an elite club.

The SME Bank also spent more than N$2 million on hotel accommodation and flights to fly Hangula around the globe between 2016 and 2017. Most of the money was paid for flights to Dubai.

She told investigators she did not “notice or realise at the time that the amounts which were paid to her were not paid into her bank account(s) by the SME Bank itself, but she believed that the amounts were paid to her by the SME Bank”.

Hangula’s profile started rising in 2015 after she was appointed to two powerful parastatal boards.

One is the Development Bank of Namibia, where she is the chairperson, and the other is

Namib Desert Diamonds (Namdia), where she was deputy board chairperson.

FINALISED IN THE LOBBY

The SME Bank was established in 2012 when president Hage Geingob was trade minister.

Geingob’s personal assistant at the trade ministry then was Mbako, who was the go-to person between the minister and other officials – including for information about the setting up of the SME Bank.

Now documents show that Mbako had a meeting with the SME Bank’s Kamushinda two years before the bank was founded.

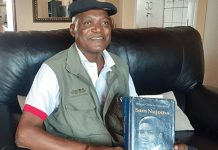

Esau Mbako

Mbako is quoted in the court papers as saying he arranged a loan agreement with Kamushinda during 2010 in the lobby of the Windhoek Country Club Resort and Casino.

The liquidators are also on Mbako’s back.

The claim against Mbako is for around N$970 000, for money he allegedly received as part of a “gentlemen’s agreement” with Kamushinda, the SME Bank’s former deputy board chairman and alleged kingpin of the looting.

The arrangement was a verbal one with no paperwork between the two men.

“The payments, making up the amount of N$970 000, were made in an illegal manner,” the liquidators said. This payment enabled the transferring of stolen funds, the liquidators said.

The biggest chunk of the money paid to Mbako came from Kamushinda’s company AMFS, which received N$79,8 million from the SME Bank between 10 April 2015 and 11 August 2016.

Mbako, according to the liquidators, received N$970 000 from Kamushinda between 2015 and 2017.

The money came to Mbako and his wife, Pearl Mbako, through Asset Movement and Financial Services (AMFS), Ivana Enterprises and Mysen Trading, all of which, according to court papers, received proceeds of money stolen from the SME Bank.

The money came through the bank accounts of his wife and her company Yatsua Investments.

ANOTHER MBAKO LOAN

Mbako did not only benefit from the Kamushinda ‘loan’.

The SME Bank directly issued him another loan in November 2015 to buy a Toyota Land Cruiser V8 VX.

The loan duration was 60 months, with monthly instalments set at N$17 600.

At the time Esau’s monthly gross salary was around N$30 000.

During the same period – from September 2015 to December 2017 – he or his wife were receiving N$35 000 monthly from Kamushinda-linked entities, and Mbako was also in the process of paying off his N$802 950 vehicle loan with the SME Bank.

Mbako threatened to sue The Namibian three years ago over a story about his dodgy loan.

Mbako claimed in court papers he was in financial distress and needed a loan to cover his expenses, hence he turned to Kamushinda, the liquidators state in their claim against him.

He yesterday said he would defend the case.

“The combined summons which seek to obtain an order compelling me to repay about N$970 000 in monies advanced to me by Mr Enoch Kamushinda contains many errors and false allegations that I am in cahoots with Mr Kamushinda [and] knowingly stole money from the SME Bank,” he said.

“I am therefore challenging these allegations against me. Fact is, I requested for a loan from Mr Kamushinda with the view to repay such a loan – and that was way before the SME Bank opened its doors. Now, to allege that I stole much, is a gross misrepresentation of facts.”

The liquidators are trying to recover at least N$247,5 million, which they managed to trace, while still working on tracking the remainder of N$400 million believed to have been looted from the bank.

They also state in court documents that after about N$250 million had been laundered through various bank accounts in South Africa, about N$50 million was “relaundered back to Namibia to dish out to the Namibian participants in the grand scheme of fraud”.

* This article was produced by The Namibian’s investigative unit and the Advancement of Journalism Centre.