By Shinovene Immanuel | 11 March 2022

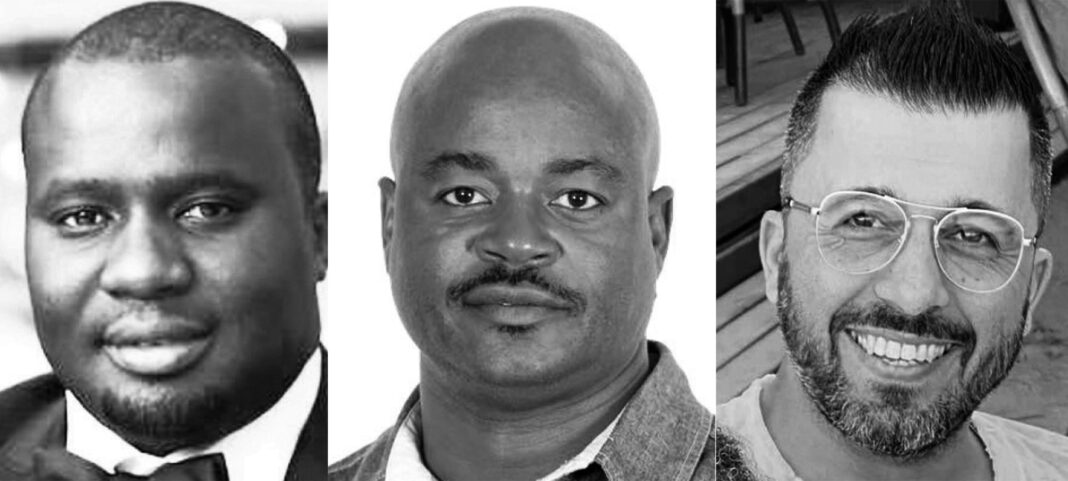

BUSINESSMEN John Walenga, Tironenn Kauluma and Doron Cohen are among the key beneficiaries of a company that received around N$138 million over four years for valuating gems for the Namibia Desert Diamond Company (Namdia).

Israeli diamond dealer Cohen – a key player in the deal – yesterday admitted to The Namibian that the business was “seemingly started to line the pockets of a few individuals”.

Together, they benefited from the spoils of a controversial diamond-valuating deal which is now criticised by senior government officials, such as minister of public enterprises Leon Jooste, who says their company was not necessary.

The deal, however, provided enough cash for a clique of three people to splash on luxuries such as two BMW X5s, one BMW M5, and a Lexus SUV.

Documents show that N$33,1 million was transferred to Walenga, while Kauluma was allegedly paid close to N$35 million.

Cohen and his company were paid around N$46 million.

Namdia – born out of a 2016 agreement between the government and diamond giant De Beers – was meant to be the government’s diamond sales and marketing arm.

Its main aim was “to discover the price of Namibia’s diamonds in the international market”.

As a result of the De Beers agreement, Namdia was given the right to buy 15% of Namdeb Holdings’ production.

Namdia would then sell the diamonds to its own clients.

But there was a catch: The then mines minister, Oberth Kanjoze, and former attorney general Sacky Shanghala silently appointed a middleman to valuate Namdia’s diamonds before selling them to their clients.

The company was called C-Sixty Investments, and it was owned by Shanghala’s close associates Walenga and Kauluma – a nephew of former minister Helmut Angula.

Questions were raised at the time about why Kandjoze and Shanghala hand-picked a little-known company to valuate Namdia’s diamonds.

The government has now discarded the role of C-Sixty in the valuation process.

But it seems too little too late as a group of less than five people benefited from around N$138 million through a valuation deal.

Documents seen by The Namibian provide insight into how Namdia was possibly used as a conduit for a scheme that benefited a coterie of politically connected individuals known for their lavish lifestyles.

POCKET MONEY

The company would be paid by the Ministry of Mines and Energy while the gems that would be valued belonged to Namdia.

C-Sixty Investments was paid based on how many Namdia stones it valued.

The amounts floated between N$2 million and N$5 million per month. It was paid by Namdia or, in some cases, the energy ministry.

Documents show that the company used a First National Bank Namibia account from October 2016 to 2017. Just a year into existence, funds from Namdia valuations were used to pay for nice-to-have vehicles.

This was the start of what has been described as free money channelled from deals related to the state diamond company.

In total, Walenga – a close associate of trial-awaiting imprisoned businessman James Hatuikulipi – was paid around N$33,1 million through various entities he controls from C-Sixty’s bank accounts.

That amount includes N$14,4 million paid to a Walenga-controlled entity called Oshitapo Trust, as well as a company called Omalaeti Foods, which received N$13,9 million.

In total, Walenga received more than 50 payments from 2016 to 2021. These payments ranged from N$100 000 a month to N$1,5 million a month.

In some cases, he was extended loans, such as N$1 million for his company Omalaeti Foods, by the controversial gem-valuating company.

It’s unclear whether he has repaid the loans.

C-Sixty records show that around N$1,2 million was used to pay for Walenga’s Lexus SUV.

Walenga told The Namibian he does not owe the public any explanation for how he used the money derived from the diamond valuation deal.

“Our company was a proprietary limited. Thus the income we received was in return for the services we rendered as per the agreement,” he said.

Walenga insisted they had a contract with the government.

“The opinions of other people . . . are irrelevant. Namibia is governed by applicable laws as opposed to the rule of men,” he said.

THE FREQUENT FLYER

Kauluma, also a relative of former defence minister Peter Vilho, received payments of close to N$35 million, and bought two luxury vehicles.

The company eventually paid N$1,4 million for Kauluma’s BMW X5.

C-Sixty also paid for Kauluma’s BMW M5.

He also received more than 50 payments from 2016 to 2021 with N$2,9 million being the highest loan amount extended to him.

Kauluma, who also owns a company called TNK, received several loans from C-Sixty – ranging from N$300 000 to N$700 000.

It’s unclear if he repaid these company loans. The same company also paid for Kauluma’s trips to Dubai.

The globetrotter is also a beneficiary of the government’s solar project through state-owned NamPower.

Alcon Consulting Services, the company that won the contract to set up a solar power plant at Aussenkehr, appears to be dominated by former Cabinet minister Helmut Angula’s family.

Besides Angula, the company is also led by his nephew Tironenn Kauluma, and Menesia Vilho, Peter Vilho’ wife.

Questions sent to Kauluma went unanswered.

PALACE COUP D’ETAT

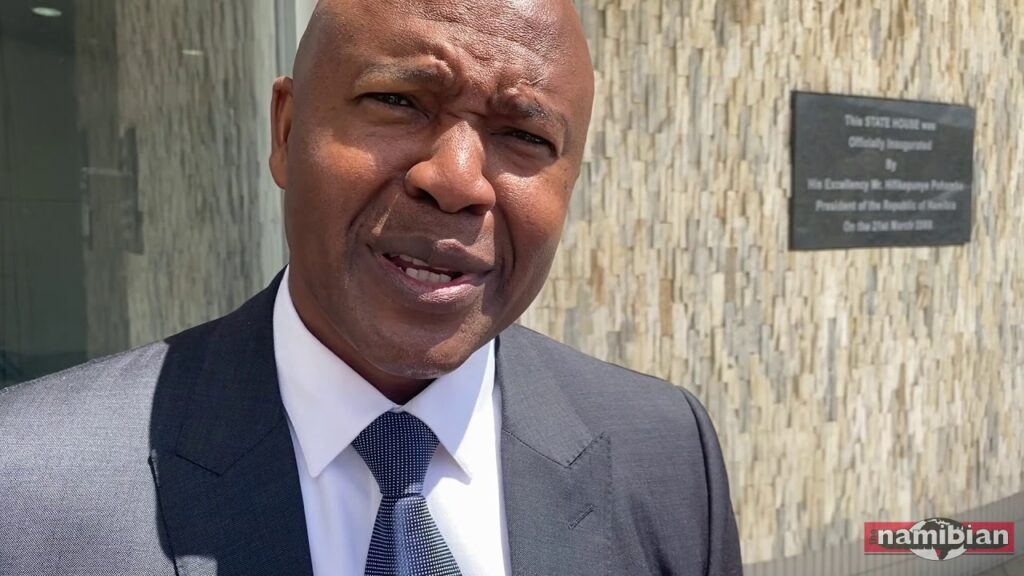

Another key beneficiary of the Namdia valuation deal is Cohen, who has made friends with Namibia’s elite.

Cohen describes himself as the main technician behind C-Sixty’s operations.

He ran the rough diamond valuation process that was used at Namdia.

He was paid N$46 million that includes N$30 million through Nuska Commercial and N$16 million in consultation fees. Around N$1,8 million was paid to his Mazal Trust Fund.

Doron Cohen

His fees ranged from N$378 000 to N$468 000 a month.

Cohen had a dirty power struggle with Walenga and Kauluma over the control of C-Sixty.

After years of infighting, Cohen removed Walenga and Kauluma from the company.

In 2019, diamond valuators started complaining that their salaries were paid late and that their Social Security, pension and tax deductions were outstanding.

Allegations emerged that the salary deductions were made from paychecks, but were not passed on to the relevant authorities.

That same year, Cohen said he was asked by the mines and public enterprise ministers to report any possible irregularities at Namdia.

This resulted in confrontations with some of the C-Sixty owners about certain information being excluded, he said.

“This eventually led to the owners, who realised they could no longer provide this service without my expertise and technology, offering me the opportunity to purchase the company,” Cohen said.

He eventually took over C-Sixty Investment from Walenga and Kauluma and allegedly paid N$17 million to buy them out.

Cohen is currently embroiled in a court battle with the mines and energy ministry to remain in the valuating deal.

To him, their role is vital in making sure Namdia does not sell its diamonds abroad for peanuts.

“At present, the company is involved in an arbitration with the ministry of mines and resultantly cannot divulge any further information on the matter,” he said yesterday.

He insisted he was paid a monthly fee of N$328 000 for his services to C-Sixty.

“Initially, I was only a service provider, and my point of contention has always been that the real value Namibia can realise from the sale of her rough diamonds, which can only be obtained using the valuation method I introduced, has not been achieved,” he said.

“Yes, in October 2020, I assumed full ownership and control of C Sixty after a dispute arose between myself and the previous owners and they could no longer tender the valuation service without my expertise to the Ministry of Mines and Energy.”

Minister of public enterprises Leon Jooste yesterday said Namdia should have opted for a cost-effective process instead of using the company appointed by Kandjoze and Shanghala.

“I think Namdia could have secured access to the same equipment in a different agreement and much more cost-effective manner,” he said.