By Tileni Mongudhi and Ndanki Kahiurika | 7 April 2016

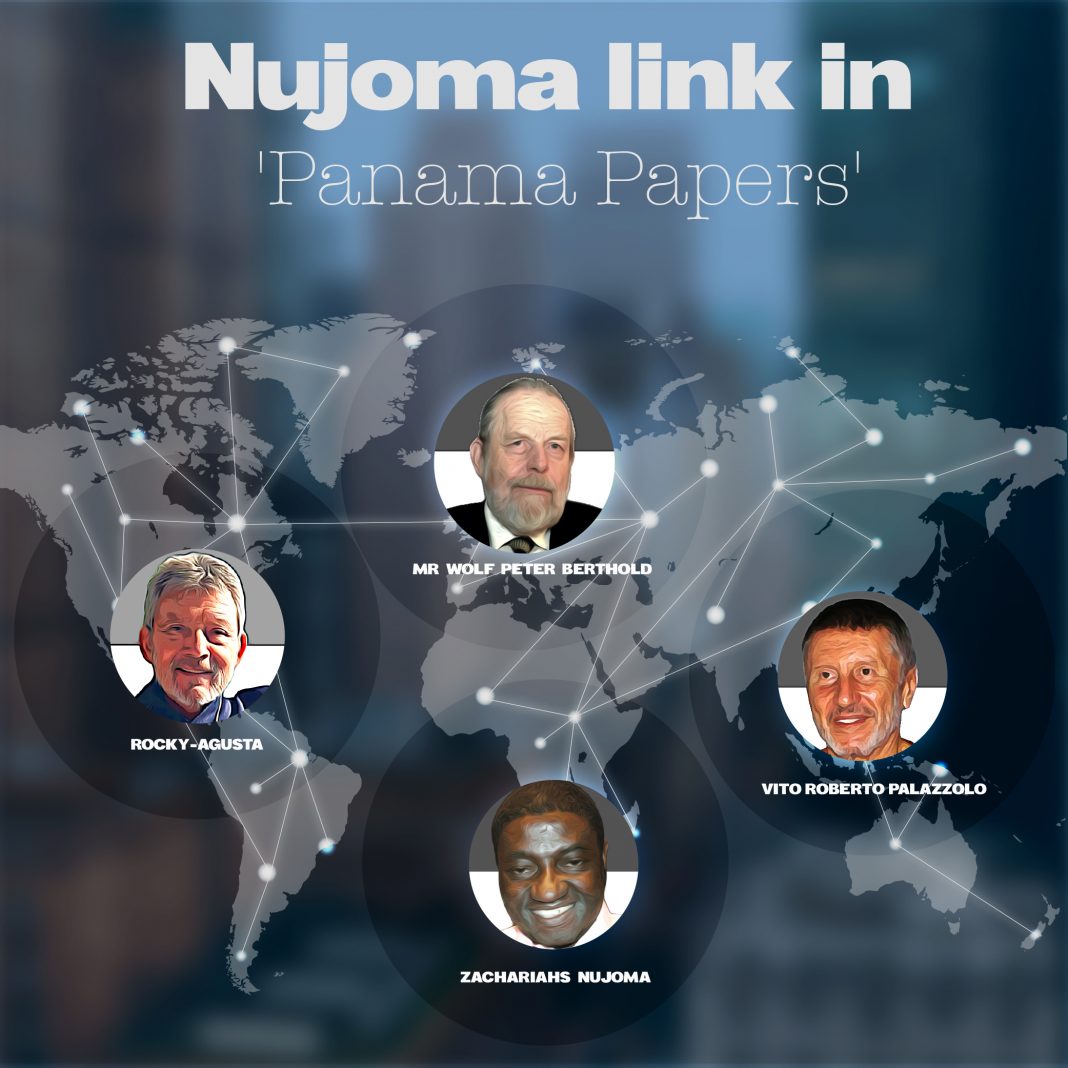

LEAKED documents reveal how the son of Italian convicted Mafioso, Vito Palazzolo, and the son of his best friend, Count Rocky Agusta, teamed up to sustain their fathers’ illicit businesses through offshore firms by using a former German banker.

The leak dubbed the ‘Panama Papers’ also reveals new details about the well-publicised Mafia’s business connection between the Italians and Namibian businessman Zacky Nujoma, the youngest son of founding President Sam Nujoma.

Even though the criminal syndicate’s kingpin financier, Vito Roberto Palazzolo, is in prison, the Mafia empire continues to flourish, thanks to a Panama firm that helped shield the companies from Namibian, Italian and South African state authorities by using tax haven companies in the British Virgin Islands.

This has effectively hidden the Sicilian Mafia’s (also known as Cosa Nostra Costa) complex revenue system from investigations in those countries.

Data from Panama-based law firm Mossack Fonseca, leaked to German newspaper Süddeutsche Zeitung and shared with the International Consortium of Investigative Journalists (ICIJ), which in turn roped in other media houses such as The Namibian’s investigative unit, shows how the Palazzolo family, also known as the Von Palace Kolbatshenko, registered a number of companies in the British Virgin Islands.

With the help of Wolf-Peter Berthold, a German banker based in Hong Kong, the Palazzolos appear to have used these firms to pass on the family business from one generation to the next.

Berthold is the primary link between the Palazzolo family and Mossack Fonseca through Berthold’s Bahamas-based company Deutsche Investment Corporation, co-owned by Vito Roberto’s son, Peter von Palace Kolbatschenko.

For the past few years, the Palazzolos used Berthold’s company to open at least seven companies in the British Virgin Islands.

THE FIXER

Banker Berthold established the investment firm Deutsche Investment Corporation in 1996 in the Bahamas, and registered it in Hong Kong.

On face value, Berthold’s company sounds credible — the use of the name ‘Deutsche’ evokes the financial services’ giant Deutsche Bank.

Berthold, who has been based in Hong Kong since 1977, appears to be a former employee of Deutsche Bank (Asia), but there is no evidence of a connection between Deutsche Bank and the Deutsche Investment Corporation.

Until recently, Berthold’s company incorporated a number of offshore firms in the British Virgin Islands through Mossack Fonseca.

Leaked documents link seven firms to the Palazzolo empire: Diamond Ocean, Deutsche Investments Consultants (Asia) Ltd, Benway International Ltd, Gold Enterprises Limited, Goldfield International Ltd, Silver Group Ltd and Natural Earth International Ltd.

The use of tax havens such as the British Virgin Islands enables companies—or criminals camouflaged by corporate structures — to conceal financial activities and identities using banking secrecy, nominees who aren’t beneficiaries and the tax haven’s non-disclosure legislation to hide the records of the persons involved.

One of these entities, Diamond Ocean Enterprises Ltd, was set up in February 2005 and listed as a consulting company that provides expertise to a diamond manufacturer and polisher based in Namibia.

Mossack Fonseca records list the Deutsche Investment Consultants (Asia) Limited as a director of Diamond Ocean. The company’s shareholders include Kolbatschenko, Berthold and Giovanni Agusta.

And, according to Italian investigators, the Agusta family also plays a key role in maintaining the Palazzo family’s financial interests in Africa.

Berthold did not respond to our requests for an interview sent via email.

THE AGUSTA FAMILY

The Agusta family, a noble Italian family linked to Munich and South Africa, is famous for having created a helicopter design and manufacturing company named Agusta Spa, sold to Westland in 2000 (the company was later named Agusta Westland).

Unlike his father, Count Riccardo ‘Rocky’ Agusta was less into helicopters but more into race cars and living the good life. Since the 80s, he moved to South Africa, where he raised his sons and established a close friendship with the Cosa Nostra’s key financier, Vito Palazzolo.

Both were involved in managing South African businesses, including prestigious vineyards and wineries.

Paolo Piccinelli, who headed the Italian military police that caught Vito Palazzolo in Thailand, claimed that the Mafioso “sold his South African properties to count Agusta to avoid having them confiscated”.

The Agustas seem to play the role in the financial empire run by Palazzolo. Documents identify Agusta Enterprises Holding Company Ltd as one of the entities managed by Mossack Fonseca’s ‘client’ Deutsche Investment Corporation (Asia) Ltd, the company central to the Berthold-Palazzolo alliance.

German banker Berthold appeared to be linked to the business of both families: the Cosa Nostra-tied Palazzolos and the Agustas, who are both business partners in South Africa.

Palazzolo and Agusta did not respond to questions sent through social media.

ZACKY NUJOMA’S LINK

A previous transnational investigation by the Investigative Reporting Project Italy (IRPI) and the African Network of Centres for Investigative Reporting (ANCIR) exposed how Diamond Ocean connects Vito Roberto Palazzolo to Zacharias ‘Zacky’ Nujoma.

In 2007, Nujoma was quoted as dismissing Palazzolo’s organised crime links as ‘an old CIA story’, but claimed later not to have known about Palazzolo’s past. “Then I did not know him; now things have changed,” he said.

They had not been business partners, but ‘merely friends’, he said.

Palazzolo and Zacky Nujoma’s company, Nu Diamonds, is one of less than a dozen De Beers’ sightholders — one of the authorised bulk purchasers of rough diamonds in Namibia.

Nu Diamonds is linked to a pair of other Namibian companies controlled by Diamond Ocean.

In 2005, Nujoma acquired two off-the-shelf companies in Namibia, Avila Investments and Marbella Investments.

Shortly after Avila and Marbella obtained licences to buy and cut diamonds in Namibia, 90% of the shared capital was transferred to Diamond Ocean Enterprises Limited.

Palazzolo’s son, Kolbatschenko, was appointed director of Avila—in addition to already being a shareholder of Diamond Ocean. Avila and Marbella have since been dissolved.

The leak reveals another link between Palazzolo and Nujoma.

Natural Earth International Ltd, a company registered by Deutsche Investment Corporation (Asia) Ltd, surfaces in a deal involving Nujoma, whose political connections were key in securing an important deal in Namibia’s uranium industry.

In 2006, Zacky Nujoma established Ancash Investments (Pty) Ltd, a black empowerment firm.

Soon after, Ancash obtained seven uranium exclusive prospecting licenses from Namibia’s mines and energy ministry.

Then, in September 2006, Palazzolo advanced Ancash US$10 million in ‘financial assistance’ to support mineral exploration rights.

Following the loan from Palazzolo, Canadian uranium exploration and development company Forsys Metals Corp announced its intention to ‘partner’ Ancash on uranium mining contracts.

In that announcement, Forsys declared that Ancash possessed “strong international connections with Natural Earth International Ltd, a member of Deutsche Investment Corporation (Asia) Ltd based in Hong Kong”.

In light of the evidence in the Panama Papers, that sentence should instead read that Ancash “has strong international connections with Palazzolo, the Cosa Nostra’s financier.”

Nujoma this week refused to discuss his business dealings with Palazzolo.

“There is nothing to hide there, but write what you want,” he said, adding that The Namibian was enquiring on “old stuff”.

RED LIGHT

In August 2015, emails exchanged by Mossack Fonseca’s compliance department outlined gaps in their due diligence requirements for the companies connected to the Namibia-linked Mafia financier.

These included disclosures related to the ‘source of funds’ as well as residence and reference letters for the company Diamond Ocean.

Peter Von Palace Kolbatshenko’s identity as a shareholder of the company was placed on alert due to his familial connection to Vito Palazzolo.

Mossack Fonesca’s compliance department cited a LexisNexis dossier, concluding the “interests of organised crime cannot be excluded.”

By comparing the signatures on the leaked documents with those obtained in Namibia, we can confirm that the Peter behind Diamond Ocean is in fact Peter Von Palace Kolbatshenko, the son of Vito Palazzolo, not Vito’s brother.

This proves how the Mafia have passed the baton from generation to generation.

Palazzolo had not yet been arrested when these offshore companies were established by Berthold. It would thus not be improbable to assume that Vito transferred the business to his son in case he was arrested and charged.

Vito Palazzolo is currently in jail under the harsh law titled 41-bis term.

This Italian law allows prison regulations to be suspended for inmates convicted of organised crimes involving the Mafia.

It appears Palazzolo had little choice but to leave his empire to the next generation, which includes his son Peter.

Emails dated September 2015 quote the reply of the company Diamond Ocean to Mossack Fonseca after having been faced with the alleged Mafia-link as saying: “We want to let the company lapse as it has been dormant for many years. It does not hold any assets, and we have no intention to use it in the future.”

Diamond Ocean was closed down as requested, which means any valuable assets related to Namibian diamonds had presumably already been shifted to another shell entity.

The documents show that the rest of Palazzolo’s companies associated with Mossack Fonseca, including the ‘holding’ structure Deutsche Investment Corporation (Asia) Ltd., are still active and run by Berthold, and Palazzolo’s son, Kolbatshenko.

It is not clear whether Berthold and Vito Palazzolo were acquainted, but they were both employed by Deutsche Bank during their early careers.

Palazzolo’s banking career began at the age of 20 at Deutsche’s Hamburg office in Germany. Soon after, he would take flight as a private banker and a very capable ‘financial adviser’ for the Sicilian mafia.

For its part, Deutsche Bank was asked via email to indicate whether they had any concerns about the similar naming of the BVI company by the Mafia-related actors.

The Deutsche Bank did not respond to questions sent to them.

*This article was produced by The Namibian’s investigative unit in collaboration with Cecilia Anesi and Guilio Rubino from the Investigative Reporting Project Italy (IRPI) and Khadija Sharife from the African Network of Centres for Investigative Reporting (ANCIR), with support from the International Consortium of Investigative Journalists.