By Shinovene Immanuel | 15 April 2016

It was incorporated on 17 April 2007 in the British Virgin Islands, and Diergaardt allegedly bought it two days later.

She was issued 50 000 shares worth US$50 000, making her the sole shareholder and director. Her home address is stated in the company documents as Khomasdal, a suburb in Windhoek.

Diergaardt told this investigation that this address belongs to her sister.

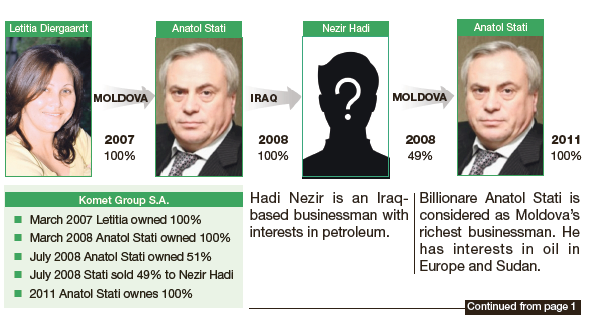

According to the leak, about a year after acquiring Komet Group, Diergaardt sold all her shares in the company to Moldovan oil oligarch Anatol Stati for US$50 000 (N$400 000), though the leaked document spell his first name as Anatolie.

Statis oil business empire has made him one of Moldovas richest individuals. Its not clear whether Diergaardt personally received anything for selling her shares to Stati.

The sale was made at a meeting on 17 March 2008, which Diergaardt allegedly chaired, while Stati was the secretary. ldquo;A motion was made by Letitia Diergardt to sell 100% shares of the company,rdquo; leaked minutes of the meeting said.

Later in the meeting, a motion was made to accept her resignation as director of Komet Group.

ldquo;It was thereby resolved that the resignation of Letitia Diergaardt from the position of director of the company shall hereby be accepted with immediate effect,rdquo; the minutes said.

Stati fully took charge of the company from Diergaardt as the sole director and owner.

If Diergaardts version that she does not know anything about the offshore companies is true, then this also puts into question the legality of this meeting, if ever there was such a meeting. Weyzig said even though the documents show that the meeting over the ownership of that company took place, the minutes do not mention Diergaardts date of birth or passport number, whereas they do mention those of Stati.

ldquo;That is odd,rdquo; Weyzig said. ldquo;If someone made false minutes and forged her signature, that might have been an illegal act. It is not clear whether payment was made in connection with the transfer of shares from Diergaardt to Stati,rdquo; Oxfams tax expert said.

Stati said in a letter dated 27 March 2009 and addressed to offshore fixer Mossack Fonseca that Komet will not be used for dubious transactions.

ldquo;Being the sole director and one of the beneficial owners of the above company, I hereby vouch that the above company will never be used for unlawful purposes, nor will it handle or deal in any way with monies derived from narcotics or any other drugs, illegal trading of arms or munitions, fraudulent transactions or any other illegal activities,rdquo; Stati stressed.

KOMET CHANGES HANDS

On 7 July 2008, a few months after taking over Komet Group, Stati sold the entire company, partly to one of his subsidiary oil companies and the rest to an external company with links to business interests in Iraq.

Stati first sold 24 500 shares (51% valued at U$25 500) of Komet Group SA to Ascom Oil Company. Ascom is his Moldovaminus;based oil company with extraction rights in Central Asia, Iraq and Sudan.

Next, Stati sold his remaining 49% stake for US$24 500 to Natural Resources Company, a British Virgin Islands offshore company owned by Hadi Nezir, an Iraqminus;based businessman with interests in petroleum.

In 2011, Nezir sold Natural Resources Companys 49% stake in Komet Group SA, a company once owned, at least on paper, by Diergaardt, to Ascom Oil Company, Statis other offshore company, for US$2 million.

Simply put, Stati paid US$2 million to Nezir to buy back the same shares he sold in 2008 for US$24 500.

In email correspondence, Mossack Fonseca, the registry agent, questioned Nezirs involvement when the firm was asked to update Komet Groups ownership documents after Stati bought back the 49% shares.

Mossack Fonseca initially maintained that it could not change the ownership records without the direct authorisation of all directors of Komet Group mdash; which at the time, the firm believed to include Nezir.

Wayne Uffleman, a lawyer representing Stati, responded that any records indicating that Hadi Nezir was a director were, in fact, inaccurate. Uffleman maintained that Anatol Stati was the sole director of Komet Group SA, a claim later confirmed by Mossack Fonseca.

It is not clear why Stati chose to buy a British Virgin Islands company from a Namibian, instead of creating an offshore company himself.

Weyzig, Oxfams Netherlandsminus;based tax expert, said on the basis of the Panama Papers documents, one cannot conclude that the US$2 million payment was made to Nezir, but it clearly shows that the 49% of shares in Komet were held by NRC, a company represented by Nezir as director.

He said the information about this transaction is not clear on why there was a sudden rise in value of Komet, or any dealings that the US$2 million payment may be related to.

Komet Group went on to be involved in multiminus;million dollar deals such as oil in countries like Sudan.

DIERGAARDTS OTHER COMPANIES

Diergaardts connection with the Moldovan businessman appears to have ended when she allegedly sold Komet Group to him.

Leaked records show her maintaining an official role in several offshore companies, as she was still listed as a director or shareholder in eight other firms. Some of those firms are still active, and they might be used for good and bad deeds.

Diergaardt was a director of Weston Commerce, Inc from 28 September 2007 to 3 March 2009. One of her cominus;directors was Stella Portminus;Louis, a serial offshore fixer, who works for Lotus Holding Company.

Portminus;Louis was reportedly a director of 338 firms registered to the same office in New Zealand.

An article by ICIJ reported in 2007 that Portminus;Louis was singled out by US president Barack Obama mdash; then a senator mdash; for directing at least 100 companies in the US state of Wyoming when he warned of serious problems confronting lawminus; enforcement as a result of minimal company ownership information requirements.rdquo;

New Zealands news website stuff.co.nz reported in 2010 that Portminus;Louis is an example of how business people from overseas with unknown credentials can be registered as directors of New Zealand companies, with no questions asked.

Portminus;Louis is linked to Geoffrey Taylor, a businessman from New Zealand who established shell companies which have since been linked to arms deals, Mexican drug lords and Russias largest tax fraud.

Taylor seems to have done it without breaching the law. Geoffreys son, Ian Taylor, is also a director of another offshore company linked to Diergaardt, Barnard Commercial SA, where Diergaardt was named as a shareholder.

Another cominus;owner of Weston Commerce, Inc. was a company named Commonwealth Trust Limited, a firm in the British Virgin Islands which sets up overseas companies and trusts for clients around the world.

The firm served as a director of Weston for one day: 9 November 2004.

DIERGAARDT RESPONDS

Diergaardt initially agreed to meet the reporter to discuss her role in the tax haven transactions. She spoke briefly over the phone, surprised about questions regarding her connections to offshore companies.

Later, she changed her mind, and responded through her attorney, Jenny de Bruyn from Van der Merweminus;Greeffminus;Andima Inc. Her lawyer confirmed that the signatures on the offshore transaction selling Komet SA to Stati are genuine, and that Diergaardt gave the signature to set up the socalled registration of the company in Namibia.

But Diergaardt had been deceived as to the purpose of the company, her attorney said. De Bruyn said Diergaardt had initially been contacted in 2006 by a lsquo;Mr Constantinersquo;, who asked that she and two other people assist him in registering a transport company in Namibia.

According to Diergaardtrsquo;s lawyer, Constantine ldquo;indicated that since he was a foreigner, he could not do so on his own (which is of course not true, but our client was not aware of this fact).rdquo; De Bruyn added that to Diergaardtrsquo;s knowledge, Constantine moved away after a few months, and the proposed company was never registered in Namibia. ldquo;This was the last our client heard of the matter,rdquo; the lawyer stated.

Diergaardt did not respond to followminus;up questions for her to explain her links to each company, the identity of the sominus;called Constantine and whether she is aware of the implications of being linked to offshore firms that she has no

control over. Questions sent to billionaire Stati and Nezir were not responded to.

*This article was produced by The Namibianrsquo;s investigative unit, with support from the African Network of Centres for Investigative Reporting (ANCIR) and the International Consortium of Investigative Journalists.

READ PART ONE HERE: Part 1: Millionaire receptionist